Quick Facts About Buying Your Vehicle Using Cash

- Before buying with cash, decide if your financial situation makes it a comfortable decision.

- Paying cash for a car means no monthly payment, and you purchase something within your means.

- Purchasing a car with cash means it’s difficult to return should something go wrong.

Learn the pros and cons of paying for a car in cash. We break down everything you need to know to make the right decision when buying an automobile with cash. Use the skip-ahead links below to move to the section you need.

- Should I Pay With Cash or Finance a Car?

- Pros and Cons of Buying a Car With Cash

- How To Research What a Car Should Cost

- How To Buy a Car With Cash

- Can You Negotiate if You Buy a Car With Cash?

- Final Tips

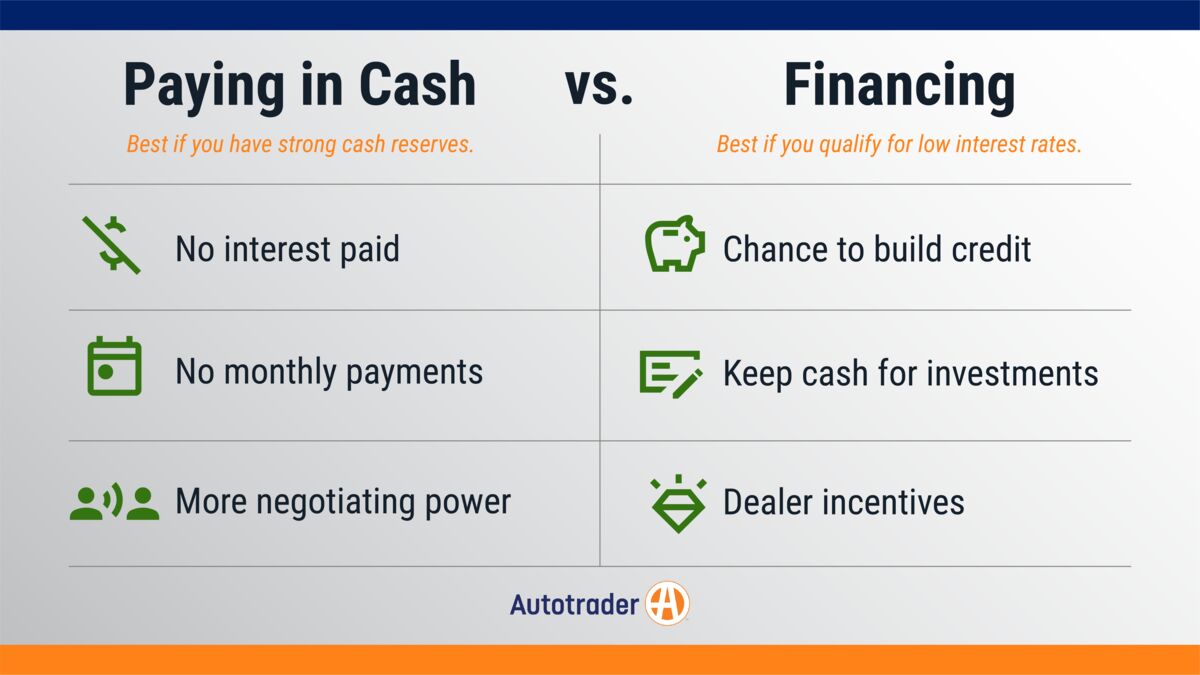

Should I Pay With Cash or Finance a Car?

First, you might wonder: Should you pay cash or finance your car?

You have two options: take out a loan and pay over time, or use savings to own the new car outright with no monthly payments or interest. Many people pay cash simply because they can, but financing can also be the right move — it depends on your finances and comfort level.

Look at the whole deal. Dealers often offer cash back, discounts, low interest rates, or even 0% financing for buyers with good credit. If your cash flow is strong, you might come out ahead by financing at a low rate and investing the money you would have used to pay in full.

Suppose you want to buy a 2026 Chevy Trailblazer with a starting price of $24,995, including destination charge, and you can afford to pay with cash. That would mean no car payment at all.

But let’s say you put $5,000 down and finance $20,000 at 6% for four years (use the Autotrader car payment calculator to run the numbers). You’d keep $20,000 in savings while making payments, and you’d pay about $2,500 in interest over 48 months.

The real question for you (and your financial planner) is whether it’s worth $2,500 in interest to keep that $20,000 liquid. Many people would rather keep the cash, where it can potentially earn back the cost of the interest.

RELATED: How Much Car Can I Afford?

What if I’m Purchasing a Used Car With Cash?

Buying used generally saves you money upfront because new cars lose value as soon as they leave the lot. Paying cash for a used car can often get you an even lower price, though pickup trucks tend to hold their value better.

Before draining your savings, weigh how paying cash will impact your emergency fund and how long it would take to rebuild it. If you plan to pay in full, research prices in advance and be ready to negotiate. Always ask if there’s a cash discount.

Also, compare what a monthly payment on a new car versus a used one would look like in your budget. Used cars may require more repairs over time, especially without a warranty; however, dealers often offer additional coverage, particularly on certified pre-owned vehicles.

If you finance a used car through a dealer, don’t expect 0% interest. You’re more likely to see modest rate reductions or promos like “no payments for 90 days,” usually only with solid credit — and you’ll still pay interest over the life of the loan.

[Editor’s Note: I have bought and sold over 30 used cars during my driving life, and I used cash every single time. It is the best negotiating tool. When you can flash actual cash, your offer has legitimacy. Cash is the ultimate closer. — Jason Fogelson, managing editor]

How To Pay Cash for a Car

Since hauling large sums of cash to a dealership is risky, the safest way to pay cash for a vehicle at the dealership is to pay using a cashier’s check or arrange for a wire transfer.

MORE: How to Exchange Funds in Private Car Sales

Pros and Cons of Buying a Car With Cash

Pros

- Discounts. Paying for a car with cash often brings leverage during negotiations.

- No car payment. Paying cash upfront means no monthly car payment expense. That’s a big deal if you suddenly lose your job or another expense needs to be addressed.

- Spend less money. There are no monthly payments, interest charges, or loan fees when you buy a car with cash.

- Buy within your means. You live within your means when you purchase with cash, and it’s a smart budgeting decision.

- Power. You get the upper hand in the deal when you pay in cash for a car. It also means you can easily walk away if you’re not satisfied.

Cons

- Financial hardship. You can face a budget crunch and put your finances at risk if you suddenly need money for an emergency and your cash reserves are depleted.

- Few to no discounts. Dealers sometimes offer incentives and discounts to buyers who finance a vehicle. When you pay cash, those disappear.

- Miss out on financing deals. If you qualify for a favorable interest rate, paying cash may not be the smartest thing to do because you’ll lose very little money by financing.

- Missed opportunity. If you could invest the cash for a greater return instead of buying the automobile, it’s a missed opportunity. For example, you could spend the money instead on a project in your home or an investment.

- Not building credit. When you buy a car outright and pay with cash, you miss the opportunity to build credit, which can help with other loans down the road.

How To Research What a Car Should Cost

Once you weigh the pros and cons of paying for your new or used car with cash, it’s time to research car costs.

Tools To Help You Research Car Costs

Like other retail goods and services, car prices can get marked up or down. For vehicles, it’s important to know the invoice price range or what the dealer pays for the car from the manufacturer. Then there’s the window sticker price or the manufacturer’s suggested retail price (MSRP).

Start by researching a specific vehicle make and model on Autotrader. On the site, you will find car MSRPs. Then, use the car valuation tool. It helps you determine the vehicle’s fair market value once you enter the make and model you’re considering. You’ll find a suggested purchase price based on different factors, including the car’s popularity and the spread between the base price and invoice price. Understand that you could pay a little less than the car’s value or a little more, depending on market conditions. Either way, this tool accurately represents where you can expect to be.

TIP: Don’t lose sight of your car buying criteria. Keep in mind reviews, lists, and comparisons to refine your search.

Understanding Trim Levels

Trim levels, sometimes called grades, offer different versions of the same model with varying features and equipment. For models with several trim choices, automakers usually offer as many as four versions. Sometimes, they offer additional choices.

For example, the 2026 Ford Explorer comes in six versions: Active 100A, Active, ST-Line, Tremor, Platinum, and ST. As trim choices increase, so does the cost of the vehicle.

Reading reviews is a great way to learn about trim packages. You can compare and contrast them and see what others think.

Car Features: What to Consider

When searching for the right vehicle that works with your budget and needs, you’ll also want to consider available car features and whether you want to add those. Those features or options could be anything, such as a head-up display, keyless entry, blind-spot monitor, heated or cooled seats, a premium sound system, and more.

Knowing what to look for in features depends on what you need and what your budget allows. When looking at added features, consider packages that bundle popular options together. Bundling can help save you money.

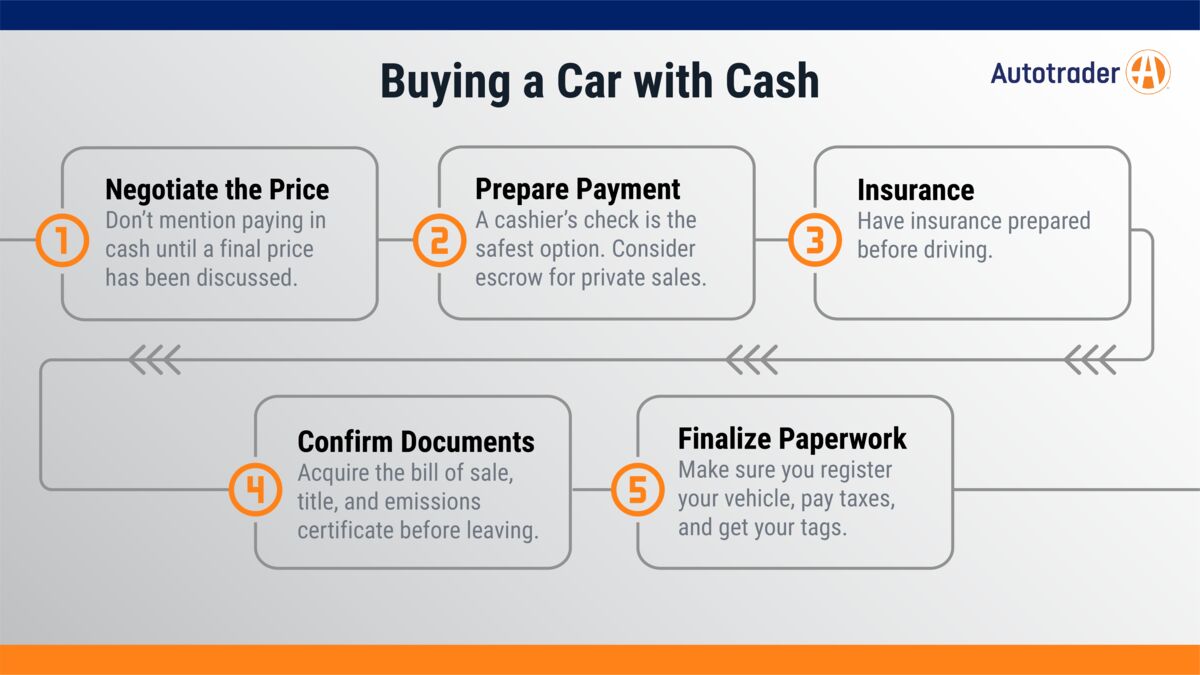

How to Buy a Car With Cash

Once you’ve selected the car you want to buy, take these steps to complete the deal.

Things To Do

- Negotiate the final price. Don’t settle on paying with cash or even mention it until the final price is negotiated, especially at a dealership. Holding back may net you a better deal at the dealership. From there, use your skills to negotiate an even better deal when you bring cash to the table. See below for more tips on negotiating the price.

- Prepare payment. The safest and most secure option for paying in cash is a cashier’s check drawn from the bank’s funds, not yours. You can also use an escrow service if purchasing a used car from a private owner. Keep all your transactions safe by never giving out banking or personal information. TIP: If your cash transaction exceeds $10,000, budget time to complete additional Internal Revenue Service paperwork (Form 8300).

- Don’t forget insurance. Even if you’re paying cash, you still need car insurance. Be prepared ahead of time and pick out your insurance before driving.

- Pay for and pick up the new car. Don’t drive away without a bill of sale, the latest emissions certificate, and the car’s title. Dealers will handle all this for you. With private sellers, it’s your responsibility to get the paperwork done.

- Final paperwork. At a dealer, registration, tags, and taxes get handled before completion. However, if you purchase from a private seller, you must still register your vehicle, pay taxes, and get your tags. Check your state’s motor vehicle agency to determine what you need to register the car.

Things To Avoid

Check out these things to avoid when researching vehicles.

- Focusing just on price. When factoring in the cost of the car, consider more than just the bottom-line number. After weighing the differences between cash and financing, consider that regardless of how you pay for your car, there are always additional costs to consider, including gas, maintenance, repairs, and car insurance.

- Scams. Watch out for selling scams. Be cautious about deals that seem too good to be true. If you’re not comfortable, walk away. Check out online reviews of small dealerships before shelling out money for a deposit, let alone a car.

- Fraudulent sellers. If a seller doesn’t own the title, find out why and be willing to walk away from the deal. Use these tips to spot fraud and get a vehicle history report from a reputable source like AutoCheck ($30) or Carfax ($45) before buying a car.

- Not researching the value of your current car. If part of your deal involves trading in your car, get the estimated value of your existing vehicle before you walk into any dealership. That knowledge helps you know what the dealership likely will pay you for your trade-in. It also allows you to more accurately budget for a new or used car.

- Not getting a used car checked by a mechanic. For a used car deal with a private seller, be sure to get the car checked out by a certified mechanic. If a seller offers a mechanic’s report, do your due diligence by checking out reviews of the shop. You can also double down and get your own assessment.

- Car dealers with no solid reputation. Stick with reputable dealers who treat customers fairly and equitably. You can also check dealer ratings on Autotrader and read other online dealer reviews.

Can You Negotiate if You Buy a Car With Cash?

You can negotiate the terms of your purchase, whether you’re buying a vehicle with cash or financing. In many cases, haggling for a lower cash price for a used car is more effective than negotiating with cash for a new vehicle. While there may be more wiggle room between how much the dealer paid for a new car from the factory and the MSRP, dealerships often make more money on financing deals than from the selling price.

Tips for Negotiating the Price

Use these tips when settling on a price for your vehicle.

- Compare other models. When settling on the price, compare other models. Exploring other options, including older models, helps you stay on budget while getting the extras you want.

- Avoid buying extras. Extended warranties, window etching of a VIN number theft protection, key fob protection, tire nitrogen costs, paint and fabric protection, and windshield, tire, and dent protection are just some of the add-ons dealers will try to upsell during the sales process. You often don’t need these protections, so weigh them carefully. Before making any decision, ask your car insurance provider what add-ons cost, like windshield protection. For example, a windshield protection add-on can cost less than $10 extra per year and often comes with a lower deductible.

- Ask for the price upfront. Yes, dealers use this tactic to lure buyers into the showroom. Also, it’s a safety net for you to see the price first. However, it gives you a starting point to negotiate a car if you pay with cash. If the vehicle will be financed, never give out the car payment range you would prefer. Seeing the price first allows you to keep the upper hand during the deal while buying within your budget.

- Consider no-haggle pricing. Many shoppers wonder if no-haggle pricing truly comes without the haggling. In a word, yes. But it’s a fixed price. It makes the process easier, but it’s probably not the best price a dealer offers.

RELATED: How to Buy a Used Car from a Private Seller

Final Tips

It’s a great feeling when you finally put your foot on the gas and purchase the vehicle. A word of caution, however. Buying a car isn’t like purchasing a refrigerator. It’s more difficult to return a vehicle if something goes wrong. When paying in cash, it’s also more difficult to return a car to a private seller.

That’s why doing research and taking your time helps prevent these situations.

Editor’s Note: We have updated this article since its initial publication.

I have been trying to buy a used/ certified car (with $30k-$35k CASH) for over 4 months. Everytime I say the word cash (or check), it has shut down any and every glimmer of hope of negotiating price. Period. Zero exceptions. So I’m not sure you are either correct or 100% truthful in your assertion of the power of cash in negotiation. Plenty of info abounds to suggest otherwise in fact.

Hi Brandon. The benefit of using cash is primarily for typical used cars and not CPO models. As with new vehicles, the dealership may get a commission for generating a loan for a CPO car through the automaker’s financing arm. That’s an incentive for the dealer to avoid cash-only payments for the certified cars you’re looking for.

If I want to effectively pay cash for a car but the dealer incentives make it more enticing to finance, and assuming there are no penalties for paying off the loan early, doesn’t it make sense to finance and pay it off when first payment is due?

You’re right, Robert. Dealer and manufacturer discounts and incentives typically apply to the initial transaction. So, assuming the lender doesn’t require an early-payoff fee and there’s no upfront loan origination fee, you could pay the loan balance in full, which would be the price after discounts or cash-back incentives. However, consider taking the deal if you can get 0% financing and hold onto the bulk of your cash for a while.

I got the $10,000 in incentives on a 2023 Challenger and paid it of with the first payment. I paid $158 in interest.

It completely depends on your personal situation and finances. If you have the cash and want to be free of monthly car loan payments, it’s a great way to be debt-free. If you think you can invest that money and make a better return – which is entirely possible – by all means, that may work better for you.

Is it a good idea to buy a car with cash?

In section above entitled “Things to Avoid”, item 5 “Not getting a used car checked by a mechanic” In 2nd sentence after item 5 U say “If a BUYER offers a mechanic’s report, I think u mean “If a SELLER offers……………” Am I missing something?

Jerry Miley, JLMiley@comcast.net

The problem with financing these days is the interest rates on auto loans have SHOT WAY UP… over 8% now.

So you’ll end up paying a LOT more for the car than you would have had you paid all cash.

Is it possible for freelancers? It’s kind of hard for us

Well that might be a blessing , if someone can pay cash. Or it might be an inheritance , and then feel guilty for getting a car ? Never know . God bless you all.

LOL. Pay cash, avoid interests and save $$ on insurance too as you can get liability only…

The question is more that if you earn say 8% on your investments and you pay 3% interest on a note, it would cost you less to finance it. And I never recommend liability, what if you are buying a 40,000 used car? Liability sets you up to lost the entire value of the car. it is not worth it. that is what you should consider when comparing the 2.

Here is my situation, I am 57, disabled and have bad credit . I am coming into a windfall and have to have a car. It will be my last vehicle purchase. I have bought on time before and been fine. This time I have to pay cash. I think I should buy a couple of years old with low miles. How do I know what cars are good, reliable and long lasting ?

This article makes no sense! From my perspective, you will still loose that $20,000 because you need money to pay towards your financed vehicle.

Pay with cash or wait until they are offering 0% interest, this is free money and you cant beat that. Before you do that make sure you can back up the loan (Pay Off) in case you loose your job.

I’ll do whatever I want with MY MONEY! I read these other posts to know that this post of yours is a scam. You’ll learn the hard way that other people’s money is something you don’t mess with. I told two dealerships that I’m taking my business elsewhere being that they didn’t want me to pay for a car their way with my money.

Tell us all- ALL, you know about buying with a rewards credit card as this could be a viable and desirable alternative !

A more expensive car is not necessarily a “better” car.

Conveniently they don’t mention that that “small” interest fee usually means you pay double the price of the car over the term of the loan with 50% going to pay for the banker’s second home on the beach that he stole for free right under your nose. The kleptocratic bankers want everyone to rent everything (a car loan is you renting the car from the bank), they also like the inflation that this stupid logic creates because it pushes out the savers and makes everyone a debt serf even to own a modest car.

There is only one good reason not to pay cash…look at the purchase agreement before you sign when paying cash…if it states that you can only return the vehicle if you financed it and have not received the loan yet, then you might want to think twice or just walk away all together. I regret my cash purchase because the dealer wouldn’t take back my car when I was dissatisfied. But then they also wouldn’t let me take it home over night. Hard lesson learned.

Use Cash if you got it and deal with the salesman on a great price. Cash is king

The people who publish this site are out to sell as many cars at as high a price as they can get away with. “expand your auto horizons greatly” is another way to say “get oversold”. In this case, if you have 8 grand to spend on a car, then buy an 8 grand car. Don’t let them put you in debt with a $30,000 car you really can’t afford right now. Don’t fall for it. Buy what you can afford with cash so you’re not gutting out a check every month for the next five years.

Well I have to say I would rather drive my 1983 Mercedes than buy a new car any day of the week. Built like a tank, close to 35 miles a gallon, and gets stares everywhere I drive.

Cash is king. Keep the debt above water and get financing that cost less than inflation. A car can always be repossessed, but your cash can’t! Be smart with your debt and you will come out ahead. New cars are expensive, but generally are much safer than cheaper used cars, and you can’t put a price on your safety (and continued cash-earning ability). So keep that cash and put it in to an asset that will generate wealth, and the little money you spend on interest will be insignificant compared to what you’ll make over time compounding in an index fund. Even better, buy the car cash and then finance with your bank – if possible? I’m still exploring the latter option.

Well, I don’t work for a car company, or a bank, or a car sales magazine, and I agree with this article.

This is unrealistic, impractical & deceiving 99% won’t qualify for that asinine 1% interest with financing which is why it’s only $300 interest. On the contrary,99% of individuals usually have mediocre,bad or no credit score so they end up paying $$$$ thousands in interest.I’ve a terrible credit score bc I was in a lot of college debt, so my score is 11.75%.I’m 100% off better paying cash, which I’ve saved for 7 years.So yeah, I’m getting my first new car at 28,but I’ll be paying cash,that’s better than getting ripped off at 20, with financing.Ive had to work so hard for my $$ grew up in foster never had anobody give me a penny for freeSo, NO! I don’t want to throw away my hard earned cash to make the net worth of filthy rich loaners higher.

Listen, I pay cash I own it. I do with it, what I want, when I want and how I want. If it breaks down, all I have to worry about is repair cost no monthly car note, I have great credit I do not need to build my credit. Why make yourself a Bill if you don’t have to.

Then there is someone like myself. I can’t afford an expensive car, but my principles and lifestyle mean that I 9ntebd to only drive electric cars, or rather those with no internal combustion.

I’m in the same boat. Can you let me know what you ended up doing, new or used hybrid?

I Think Cash is king. I would buy a car only if I afford it. When you pay in cash, you control the deal, you have the upper-hand. Otherwise, the dealership and the bank control the deal, even they force you to select certain car insurance policies.

Listen, if I have the cash for a 27K car, I’m paying for it in full on the spot. Why the hell would I even think about financing it? I’m going straight to dealer, give them the cashiers check and rolling out with my new ride. No if, ands, or buts about it!

my mother has cash to buy a car (10.000 to 15.000) her money is legal, of course she is 60 and because the place she live can not keep more than 1000 on the bank, she will be complicated to make payment cash (no check)

Me too!!

If you have no credit, but you have the cash then cash is your only option. Allot of people never had any credit, because they paid with cash. Some people are rich because they never used a credit card. It’s sad that you have to be in debt to make payments on a new car.

I’m surprised nobody mentioned the fact that you can score better deals of the new or used car when paying cash which also saves money. You could invest the extra few thousand dollars that you saved in something else after talking the salesman down when you got the cash in the bank. It’s hard for them to turn down the deal when you got the money now, I’ve learned the hard way to not buy things you can’t afford. Save up and pay up front in cash. It’s worth it!

I agree with you! that is what I am trying to do now…

One thing Michael, buying with cash offers no appeal to most car dealers. Money these days is not made on the auto itself, but in the F&I office. It is far more appealing to a car dealer when you want to finance. I have worked in the car, (and boating) industry and can definitely tell you that being a cash buyer, while it used give you leverage, is no longer a power play and offers you absolutely no advantages with the dealer, although it is certainly the wise thing to do if you can afford to do so.

I bought my new truck with cash and got a discount! Several thousand dollars!

Actually, the salesman doesn’t care… all transactions look like cash to the dealer. The only thing that changes is who’s doing the paying… the buyer or the lender. Maybe that will work with private sellers to make a quick deal rather than wait for your financing to come through, but I’ve never gotten a deal for a used car by paying cash.

Nice advice!!

You, a bank, a leasing company, it doesn’t matter to the dealer where the money comes from, so offering them cash means nothing and they won’t give you a better deal. In fact, they may give you a break if you finance through them, since they often get kickbacks from the bank.

Newsflash, in today’s economy, the regular joe schmoe isn’t getting 1% financing. The average credit score for ages between 18-54 (ain’t that a huge age gap) is between 630-650. Not exactly premium but at least it ain’t below average….in any case you aren’t getting that low a interest with those finicky numbers anyway (https://www.creditkarma.com/trends/age).

This is not right. Car payments and mortgages are for poor people who want rich people’s things. Wait, save your money, and buy everything in cash or in full. Having to finance is risky because the future is not known and, financially, things can go south very quickly. NO, pay everything in full. I respect who wrote this article, but def do not agree.

Try buying a home in California or any high cost area for cash. Average cost is $500,000. Very few people can save that up and by the time they do the cost will be $1,000,000. Rich in a poor area is poor in a rich area!

I agree. Cash, regardless of what the dealers are looking for to finance My book keeping always says cash, what you can afford. Done.

I agree with you on cars (in most cases), but not necessarily true of mortgages. Our mortgage is half the rent on an apartment with half the square footage. In fact, the apartment we lived in before cost the same as the mortgage, taxes and insurance on our home and is one-third the size. We would be wasting our money to rent. Currently on schedule to have the home loan paid off by year 10. We bought a home at the bottom of what the bank approved us for. Low fixed interest rate. We are much, much happier here. We would have been wasting our money living miserably in a run-down apartment, scrounging every cent to be able to buy a home in cash. And, provided you are wise enough to choose a fixed rate, mortgages do not increase every year, unlike apartments. Now instead of losing 100% of rent money, we are investing in a home that makes us happy, that we have no plans of ever leaving, but if we did, it is already worth 30% more than we paid for it, just 3 years later. Many people, however, buy more house than they can afford and use it as a piggy bank to buy a bigger, better home down the line and they never get out of debt. We waited many years until we found a home that we love and can afford. Yes, we will lose thousands on interest in 10 years but we would have lost 3x more in rent. And our house has increased in value by at least $10k more than we could have saved up in those three years, had we stayed at our apartment, so we would have been farther behind than we are now.

It depends where you live though. In Vancouver or Toronto where houses are 1.4 M and a condo is 500k you’d be saving a lifetime.

How could you possibly not agree? It’s not an opinion, it’s math. Most simple investments yield at least 8%, with the average being 12%. A 5 year, $20,000 loan with a 3% interest rate would cost roughly $1500 in interest. Investing that same money across that same time period would net you $12k. That’s not even considering reinvesting your gains.

There are many things wrong, inaccurate and misleading about this articles conclusions and deductions:

1. They say with financing you usually buy a “better” car than you would have while using cash, but what they should have said was that with financing you usually buy a more expensive car than you can afford.

2. It is not common thinking that buying a car with cash is better (though it should be), more people actually think financing is the better option for reasons stated above. The problem is that most people only think short term. When you put $5000 as down payment for a $25000 car, you dont have $20,000 left over because you will still pay this and more over time. What you have is the illusion that you have $20,000 left over, which could actually be very dangerous and misleading.

3. When you commit to a long term payment over paying cash, you are not factoring risk. When you pay cash, you pay for what you can afford, but when you finance, you typically commit to more than you can afford assuming your financial situation (income wise) stays the same or gets better, and we all know that is not always the case.

4. 100% of cars that are repossessed have a car note on them. I have never heard of a bank or lender repossessing a car bought outrightly with cash.

Unless they offer 0% APR to you, then no loans…

people are looking at this the wrong way. but I still think cash is better. the math isn’t as simple as “25k at 1% loan…3.5% invested in money market”. Thing is you are always paying 1% of 25k debt the entire life of the loan, but making 3.5% on less and less principle as you pay out the loan. they won’t let you hold onto the 25k until the last day of your term….ya right. net-net, go cash and avoid the hassle.

This article is straight garbage. If you have the cash, just buy the car straight out. The writer does not mention that the banks make the salesman a lot of money off the interest. Also, people fail to get gap insurance when paying on a vehicle. So, if you get in an accident with no gap insurance where you have a total loss, you have to keep paying on the vehicle while it is in the junk yard.

No, whoever wrote this article is a complete dud. Always pay in cash, no one ever wants to sit down and haggle over payment options and on top of that ridiculous interest rates being piled on top of the payments. Yeah yeah, apr and no interest fees for couple of years, but once that passes then what?

Just save your time, and if you have the money, just pay it off and go home happy. That’s my motto and it’s work everytime. =)

Don’t always “pay cash” First off, not everyone can. That’s why the banks exist. And if you ask any financial adviser about putting cold hard cash into a depreciating item (such as a car), they would advise against it. A new car normally depreciates a little more than what you pay for it so you would be throwing some money away. Put enough money down to secure you a low interest rate, such as 2.9% or a special APR such as 0% or 1.9%, and invest your TRUE cash into a money market that would get around 3.5%.

Borrowed money is cheap right now IF YOU QUALIFY FOR IT. Use someone else’s cash and let your cash work FOR YOU.

Car dealers make more money from financing than from cash payments. No surprise the author works for a car dealership. SMH

You only get 0 percent interest when buying a new car from some dealers and only if it is a car or truck that they need a quick sale on, Paying with cash is always better, BC you can make an offer and 9 times out of ten the seller will accept your offer if reasonable

It doesn’t always have to be a “car or truck that they need a quick sale on”. It has to do with marketing that particular model and if you qualify for the special interest rate on that particular model. I work at a Chevy/GMC dealership in North Carolina and right now a lot of the trucks have 0% on them.

Chevy and GMC trucks sell extremely well so they don’t “need” to put it on them. It is merely this: an incentive. If you have paid past loans well and do qualify for the special interest rates, you would go through that particular makes (Chevy, Nissan, Honda, etc) bank. Major lenders outside of these banks (BB&T, ALLY, Wells Fargo, etc) don’t offer the rates because that is how these banks stay in business. However, because you are purchasing a NEW vehicle from these manufactors, then it is more of a “thank you” from them.

You may lose some rebate money so be sure to see which way fits you better. If you have excellent credit and a particular model has high rebate money on it, it may be a better idea to take the rebate money and get a low rate from a “real bank”, such as the BB&Ts and Wells Fargos.

In my experience it has made no difference at all if you are paying cash or financing. They are going to accept the same offer either way, unless of course you are talking about financing through their finance department because there can be kickbacks and incentives for them. As an example my father paid upfront for his new Mercedes last year and they didn’t care that he paid with a check. Cash or check makes no difference to them as they still get paid the same dollar amount.

I wonder how many advertisers are in the car loan business? I really expected one of the reasons to borrow money to buy a car would be to take advantage of a 0% interest offer. However that isn’t mentioned. That said, I’d argue this only occurs when buying a new car, which is rarely if ever a good idea. To use the authors example of buying a $20k car and only paying a total of $300 in interest. So why not just say you are buying a $20,300 car, because that is what you are doing. It’s NEVER a good idea to finance something that you can afford to buy outright.

The point of this article is that you end up paying 300 dollars extra in order to keep your 20,000 in cash which you can then invest in something that earns interest. If you think you can safely make more than 300 dollars on that cash in the same amount of time by investing it, then it absolutely makes sense to finance.