Car Loan Payment Calculator

Ready to jump in the driver's seat?

How To Calculate Monthly Car Payments

Besides a house or college tuition, buying a car is one of the most expensive purchases that a person can make. Understanding the cost to purchase and operate a vehicle monthly is essential and something that is often underestimated. It’s also important not to lose sight of the total cost of buying a car when trying to lower the monthly payment with a longer length car loan.

Average Monthly Operating Cost

| Yearly Salary (Post-Tax) | $43,422 |

| 5-Year Loan Payment | $783 |

| Gas (based on SUV/Truck) | $311 |

| Car Insurance | $148 |

| Car Maintenance | $112 |

| Monthly Operating Cost | $1,354 |

| Monthly Salary Percentage | 37.4% |

Car Loan Factors Explained

Purchase Price

In 2022, the average new car price exceeded $47,000, and the median salary is $53,924 for a full-time worker. After paying income taxes on a $53,924 salary, the take-home pay is reduced to $43,422. The average used car price has surged close to 30% in recent years, bringing the average transaction to $27,633. The old rule of spending 10% – 15% of your monthly income on transportation expenses is hard to stick to, especially when you factor in rising gas prices.

The average American might spend more than 20% of their monthly income on the vehicle’s payment alone. Once car insurance, gas, and maintenance are factored in, the percentage of income being spent on transportation nearly doubles. Driving a small, fuel-efficient car can save 25¢ per mile in operating costs compared to a large SUV or truck.

Average Monthly Car Payment

| Yearly Salary (Post-Tax) | $43,422 |

| 5-Year Salary (Post-Tax) | $214,110 |

| New Car Purchase Price | $47,000 |

| 5-Year Car Loan Payment | $783 |

| Monthly Salary Percentage | 21.6% |

Down Payment

The amount of money that is spent upfront when purchasing a car is the down payment. Increasing the down payment will help lower the monthly payment and save money on interest payments over the length of the loan. If the loan has a high-interest rate (12% – 20%) consider making a larger down payment compared to a low-interest rate loan (0% – 4%)

If you are trading in or selling a car when buying the next one, it’s even easier to come up with a sizeable down payment. Discover used car values by using the Kelley Blue Book vehicle valuation guide.

Credit Score

Credit scores impact the interest rate when borrowing money for a car loan. Higher credit scores benefit from lower interest rates which can save quite a bit of money on the total cost of owning a car. Credit scores over 700 will typically qualify for more competitive car loan interest rates. Having a long-standing credit card that is paid on time will help strengthen a credit score. Also, any previous loans repaid without any late payments will count towards building good credit.

Credit Tier Ratings

| Exceptional Credit | 800-850 |

| Very Good Credit | 740-799 |

| Good Credit | 670-739 |

| Fair Credit | 580-669 |

| Poor Credit | 300-579 |

Interest Rate

Almost all car loans have an interest rate except for new car loans from the manufacturer that can occasionally be found for 0% APR. Having a good credit score will qualify buyers for lower interest rates since the risk of car loan default is lower. If the car loan has a high-interest rate, it’s wise to increase the down payment when buying a car.

Loan Terms

Loan terms consist of the length of the loan and the interest rate. These days, the average loan length is 72 months, and loans usually range from 36 months/3 years to 84 months/7 years. A longer loan term will increase the amount of interest paid over the length of the loan since you’re using the money for longer. In addition, the amount paid towards the loan principal each month is lower in the early parts of the loan. When choosing a long-length loan, it is important to consider that some car manufacturer powertrain warranties will expire before the loan ends.

Car Loan Tips

Check Multiple Lenders for The Best Rate – While it can be hard to beat new car loan rates from the manufacturer, it certainly wouldn’t hurt to check the interest rates at your bank or credit union. Comparing interest rates can pay off big time when buying a used car since the annual percentage is higher and can have a broader range than a new car.

Don’t Overextend Your Budget – Spending a large percentage of monthly income on the car loan payment may lead to trouble down the road when it comes time to pay for operating costs. Budgeting $450 – $600 for monthly operating expenses depending on the type of vehicle and how many miles it’s driven will help prevent any hidden surprises.

Don’t Co-sign for a Car Loan – Having a good credit score is necessary to qualify for lower interest rate car loans, and co-signing somebody else’s loan may jeopardize your credit score. If the lendee cannot repay the lender on time, it becomes your responsibility to make timely payments. Any late payments or loan default will negatively impact both people’s credit scores.

Car Shopping & Buying Tips

Featured

Leasing a Car: What Type of Damage Will You Be Charged For?Avoid surprise lease-end fees: understand normal wear vs. excessive damage, fix dents, scratches, gl...

Car Shopping

Car Shopping

Frequently Asked Questions

Many factors go into a new or used car payment. But it’s easy to estimate a car payment by using the Autotrader car payment calculator. It incorporates all the factors you will need to calculate the payment on the vehicle you want to buy, including loan amount and terms plus interest. Our guide on the topic breaks down more helpful information about what you need to know when determining your car payment.

Using the car payment calculator, fill in information like car price, interest rate and loan terms. The calculator also provides a place to add the sales tax rate for your local area. To get closer to seeing the actual payment, be sure to insert your down payment information plus your car’s trade-in value, including any amount you owe. That’s how you calculate monthly car payments. Need help determining the trade-in value of your vehicle? Easy! Use our car valuation tool to get an estimate.

It can be tricky to calculate a lease payment, because it includes items like “money factor”, “residual value” and depreciation. When dealerships offer car lease deals, they usually calculate it all for you. Car leasing payments are typically lower than new car payments if you were buying the car. Still, the amounts can vary, depending on the size of the down payment on the lease and other factors that you’ll discuss up front.

Banks and other lenders calculate car loan payments using complex formulas. For example, a bank determines the interest rate you qualify for based on your credit score, debt-to-income ratio, and other factors. Suppose you pre-qualify for a car loan and know the interest rate and the sales tax rate in your area. In that case, it’s easy to calculate and estimate your vehicle loan payment using our car calculator tool.

To determine your car payment with interest, you would first shop around with different banks and lenders. That way, you can find the best interest rate you can qualify for based on your credit history and other factors. Using our car payment calculator, you can add interest and the tool amortizes the amount (aka “spreads out the amount over time”) and provides an estimate of what you can expect your car payment to be with interest factored in.

According to credit agency Experian’s State of the Automotive Finance Market, the average new car loan interest rate is 3.48% for buyers with credit scores in the range of 661 to 780. The average used car loan interest rate is 5.49% for purchasers with scores in the same range.

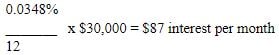

Many dealerships offer special interest rate pricing, including 0% financing on car loans. But not all car buyers can qualify for those low rates. Once you know what interest rate you can qualify for from your lender, you can calculate interest on a car loan, but it entails some math. You will divide the interest rate by 12 for the number of monthly payments in a year. Next, you take that answer and multiply it by the balance of your loan. For example, based on a $40,000 balance with a 3.48% interest rate:

The best vehicle loan interest rate is 0% for new cars. But manufacturers don’t always offer these special promotional deals. For used vehicles, 4.75% may not be the lowest interest rate available. Not every new or used vehicle buyer can qualify for the lowest interest rate advertised by the lender either at the dealership or bank. Since each lender uses a different formula to calculate interest rates, it’s best to shop around for the lowest loan terms that meet your needs.

Yes, it’s possible to finance a car for 72 months. However, early in a car loan, most of each monthly payment goes toward interest. It takes several years to build any equity in the vehicle and cars depreciate quickly in the first several years of ownership. As a result, the longer the loan term, the longer it takes to accumulate any value in the car. In other words, you will be upside down in the auto loan until you reach the point where the vehicle is worth something as a trade-in. Read about car financing in our guide to learn more.