What You Need to Know

- When you finance through a dealership, yes, taxes and dealer fees are typically included in the car payment.

- However, with private sales, you generally can’t roll taxes and fees into a loan.

- Expect to pay about 10% of the car’s purchase price in fees when you buy through a dealer. Some fees are negotiable, while others are not.

If you’re thinking about buying a car, you likely know that the advertised price probably won’t be the price you pay. That’s because you’ll have to add taxes and some fees to your costs, which means you might spend a few thousand dollars more than the expected price.

When you finance a car through a dealership or another lender, the taxes and dealer fees are almost always part of the payment. Adding a dealer option will slightly increase your monthly payment because it’s rolled into the total amount you’re financing. It’s also why, in many states, the dealer can get your license plates for you, because they’ve collected the taxes you owe on the vehicle. The finance amount is usually based on the car’s out-the-door price, which includes all taxes, fees, and extras, such as an extended warranty.

How Much Are Dealer Fees?

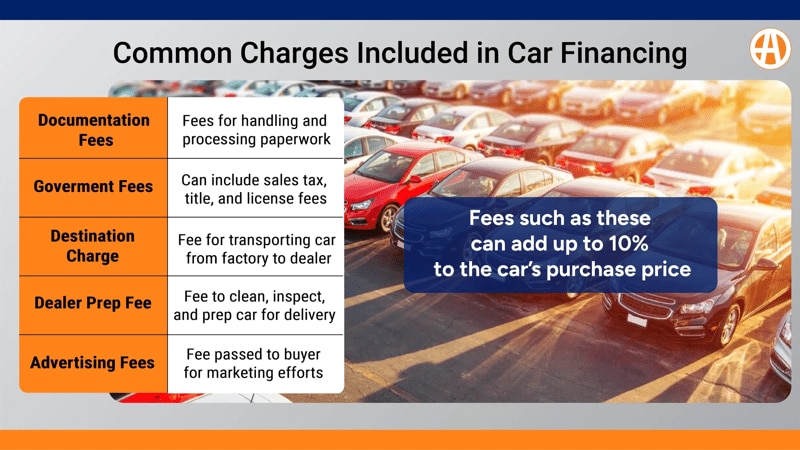

Dealer fees can range up to 10% of the vehicle’s cost. You will be responsible for sales tax or ad valorem taxes. Buyers of new cars must also pay destination fees, which can range from about $1,000 to $2,300 or more. Dealers don’t directly profit from these types of fees.

However, there are types of fees appearing on your invoice that are pure profit for dealerships. You may also see fees related to vehicle identification number (VIN) etching, paint and fabric protection, advertising, or other add-on options.

When fees appear on your sales invoice, ask your salesperson to break them down, especially those that don’t involve regulatory or government matters. It also really helps to do some research before jumping into negotiations. If you know that tag and registration fees cost $100 at your DMV, you might expect a small upcharge for the convenience. But if you see a $899 documentation fee, ask for a breakdown of costs.

Some states limit the documentation fee by law. In other states, these fees are unregulated. When it comes to hidden fees, be extra careful. You don’t need to pay $500 for fabric protection when you didn’t ask for it on your vehicle’s upholstery. These are pure dealership profits, and these types of dealer fees are negotiable. Another important note here is to shop around and compare multiple dealership out-the-door quotes.

When Car Taxes and Fees Are Not Included

There are times when taxes and fees don’t get included in your vehicle financing, including:

- If you’ve arranged your own car financing. Typically, when you arrange your financing, you’re buying a used car from a private seller, or you receive a better interest rate from your bank or credit union for a new or used vehicle, and choose to use its services rather than a dealership’s financing. In many cases, taxes and fees can be included in this type of financing, but you’ll have to plan for it.

- In the sticker price. If you show up at your dealer with a $25,000 cashier’s check for a $25,000 car, you’ll run into some problems. But if you ask the dealer to show you the out-the-door price in writing before you get the bank check, you should avoid any issues.

- If you buy a car from a private seller, you generally won’t be able to roll taxes and fees into the loan because a private seller isn’t set up to collect taxes for the state. That means you’ll usually be on the hook for these taxes when you register the car. In some cases, you might be able to ask your bank for a little extra money on the loan to cover this sort of situation, but they might not always provide it.

Should I Include Taxes and Fees in My Auto Loan?

Including car sales tax and fees in your financing reduces the out-of-pocket money you initially pay when buying a car. If you pay them separately, your savings account immediately drops by that amount.

| Consider This Scenario: Suppose the dealer fees and sales tax total $3,000. Adding that to your loan lets you keep that money and have it available for an emergency or use for another purpose. However, your monthly loan payment will increase, and you’ll pay interest on the additional amount for the life of the loan. For example, increasing a loan amount by $3,000 at a 4% interest rate over 60 months increases the monthly payment by $55, and you’ll pay $315 in interest for borrowing those funds. |

Carefully assess your budget when deciding whether to pay a lump sum as part of your down payment now or to spread it over many months, paying more in the long run.

MORE: Things to Know About Taxes When Buying a Car

What About Leasing?

Most states treat taxes on leased cars the same way they treat regular financing. That means you’ll be able to roll the sales tax and other fees into the lease payment rather than pay upfront.

However, some states require you to pay the full sales tax on the car when you sign a lease. This may seem like a big number, but remember: You would’ve paid this figure anyway if you rolled it into your lease payments.

If you are considering a lease, be sure to check out our monthly list of Best Lease Deals to help you find your next vehicle.

Editor’s Note: This article has been updated since its initial publication. Doug DeMuro contributed to the report.

Do you answer the question? Or am. I doing something wrong? Because I need a few answers.

How can a customer find out by state which state will allow you to roll the fees into your monthly payment? I know i was leasing from NY and they allowed me to roll the fees into my monthly payment. Now is upfront cost or due at signing can those be rolled and in what state ?

How can a customer find out by state which state will allow you to roll the fees into your monthly payment? I know i was leasing from NY and they allowed me to roll the fees into my monthly payment. Now is upfront cost or due at signing can those be rolled and in what state ?

Thanks for the article and all the info provided! Very useful to know!

i leased a 2020 x3i bmw and paid 15k down which included all taxes-fee’s , i ended up hardly driving it cause of covid 5k in 30 months so i bought out the lease when i went to transfer it in my name at the dmv they charged me sales tax again $2700, i already paid $5800 sales tax, should get the $2700 back from ca. tax board?

on a new car should car tax be put on the bill before the buy out price

I bought a used car and charged a doc fee and processing. What is the difference?

When financing a new vehicle purchase, do I pay on the total price or the amount paid after down payment?

I’ve leased a Ford through Ford credit and I was told by the dealership that they require excise tax be paid in your payment. However, they then apply sales tax to the full payment. Shouldn’t the sales tax come after the base payment? Doesn’t this mean they’re taxing the tax? And obviously, I’m paying more because of there formula. The worst part is that excise tax is rolled into my payment and therefore no way to deduct the amount of the tax come tax time as I’ve done on every one of my cars. It seems like a ruse to get more money from me except I can’t figure out who benefits…I know it’s not me.

what if you pay the taxes and fees up front yourself? And how does this works when your buying a vehicle outside of your state?

I am reviewing my loan docs and it looks like they charged me tax on total bill,tags,doc prep,etc. Is this correct, and can I get a reimbursement for overages if they made error?

I bought my car state I don’t understand why they didn’t add the tag into the loan?

Can I pay the taxes upfront to avoid it gathering interest? What are the pros and cousin doing so?

I meant cons obviously, lol

If I’m buying a car, is tax added to all the extra options that I put on the car? For instance, is tax added for me to add like a different stereo system?

Yes. Most tax is a percentage of the total price.

What if I have problems with the car dealer. And all I owe is the car taxes and I dont pay her. Will it affect me or them

I am having the same problem