Quick Facts About Buying a Used Car From a Private Seller or Dealer

- Private sellers usually cost less and give you more leverage but demand more time, DIY paperwork, and risk; dealers charge more but offer one-stop shopping, easier financing, and a regulated setting.

- Wherever you buy, get a vehicle history report, confirm maintenance, check market value, and shop interest rates before you sign.

- In today’s tight, high-rate market, you may compromise on the car, but you can still save by negotiating hard, questioning fees, and skipping extras.

As you navigate the rocky path to buying a used car in today’s lopsided market, you may have considered cars offered by dealers and private sellers. There are advantages to both options, but you’ve probably asked yourself, “Which is better?”

Used car prices hit record highs during the pandemic in early 2022, then swung wildly before easing through 2023 and the first half of 2024. Wholesale prices—the auction prices dealers pay—have been relatively stable in 2025, with only modest recent increases that could mean small, predictable bumps for consumers.

The market is still challenging inventory is tight, so you may have to compromise between what you want and what’s available, whether you buy from a dealer or a private seller. At the same time, lenders are stricter, and interest rates—already higher for used cars than for new—remain a sticking point. If you finance a used car, expect higher monthly payments than a year ago.

Against that backdrop, the choice between dealer and private seller comes down largely to how much time and money you can invest. Below, we break down the pros and cons of each option.

- Buying a Used Car From a Private Seller

- Buying a Used Car From a Dealer

- What to Consider Before Buying a Used Car?

- Which Is Better?

Buying a Used Car From a Private Seller

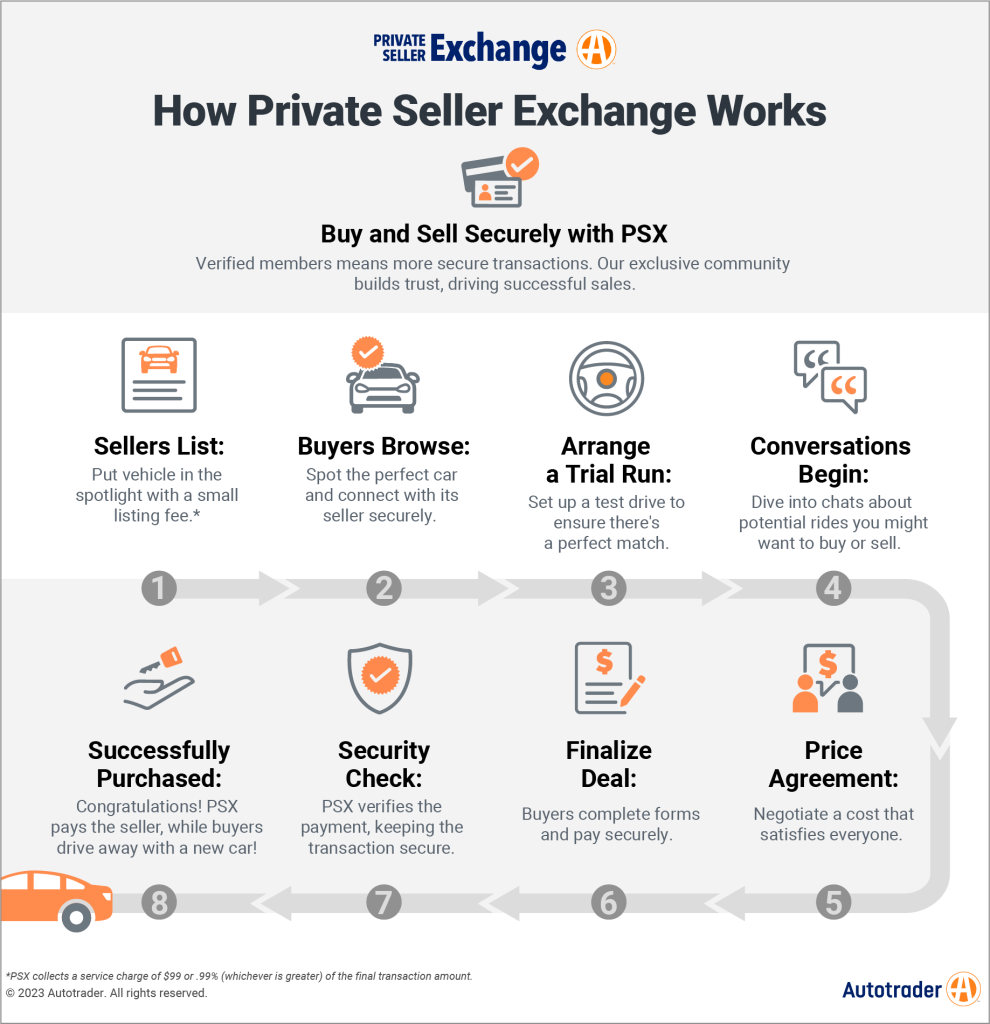

You may be hesitant to buy a used car from a private seller if you’ve never done it before. It can take more time than going to a dealership and comes with more unknowns. However, buying peer-to-peer through Autotrader’s Private Seller Exchange (PSX) can reduce many of those uncertainties and save you time. A strong reason to buy this way is simple: the seller has the car you want at a fair price. You can verify the price using Kelley Blue Book’s valuation tool.

PRO TIP: Before you start, get the vehicle identification number (VIN). It’s on a metal strip on the driver’s side of the dashboard where it meets the windshield. Ask the seller for it or snap a photo during the test drive. You can also get the VIN from the car’s license plate number.

Pros of Buying a Car From a Private Seller

- Lower transaction price: In a peer-to-peer sale, you take on some tasks a dealer would normally handle (like the title transfer), and the seller doesn’t have dealership overhead to cover. A dealer is effectively a middleman who builds profit into the price. With a private seller, you avoid that markup. Still, the deal is only as good as your negotiating skills — it’s up to you to secure a fair price.

- Greater bargaining power: For the reasons above, a private seller’s asking price is often lower than a dealer’s, so negotiations usually start from a better baseline. You also gain leverage because, by the time you’re negotiating, the seller has already invested time in photos, listings, messages, and showings. Standing there with cash or a cashier’s check makes walking away costly for them. They can kill the deal, but it means starting over. PRO TIP: It never hurts to calmly remind the seller of that if talks stall.

- More control: In a peer-to-peer sale, you can move at your own pace with someone who’s likely no more experienced selling a car than you are buying one. At a dealership, the seller has the home-field advantage: you’re on their turf, on their timeline, and they sell cars every day. Even if you arrive wanting a specific car, they may steer you toward something else. Staying focused and making clear-headed choices is harder when you’re dealing with a professional whose job is to sell.

Cons of Buying a Used Car From a Private Seller

- Time eater: Buying from a private seller almost always takes more time than buying from a dealer. You still need to talk with the seller and travel for a test drive, but you must also coordinate a safe meeting place and time, arrange financing with a third-party lender if you’re not paying cash, and visit your local tag office to transfer the title and pay sales tax. Added up, the extra time in a peer-to-peer sale is significant.

- Numerous unknowns: Unless you’re buying from someone you know, you’re dealing with a stranger. That creates mutual wariness: Is the title clean? Is it safe to bring cash? These are valid concerns in a private sale.

- No financing: If you can’t pay cash, you’re on your own to secure a loan. Private sellers can’t offer financing; most dealers can.

- No consumer protections: Federal “Used Car Rule” protections apply to dealers, not private sellers. Dealers must follow rules about how they represent a car’s condition and warranty; private sellers don’t. PRO TIP: Any promise that isn’t in writing is essentially unenforceable. Get everything in writing.

- Handling the paperwork: Dealers typically handle the title transfer, registration, and sales tax. In a peer-to-peer sale, you’re responsible for all post-sale paperwork.

- No trade-in: A private seller usually won’t take your current car in trade, because they’d then have to sell it themselves. You’ll need to sell your old car separately, which means more work and more time.

- No warranty: Unless the original factory warranty is still active, a car bought from a private seller typically has no warranty. Dealers may offer short used-car warranties, and franchised dealers can sell certified pre-owned (CPO) cars with added factory coverage. With a private seller, what you see is what you get.

- Car history report: You should never buy a used car without a vehicle history report. Many private sellers don’t provide one, so you’ll need the VIN and will have to purchase a report yourself, usually $25–$45 for an AutoCheck or Carfax.

Buying a Used Car From a Dealer

Many shoppers feel more comfortable buying from a dealer. It’s generally a safer, more controlled environment than meeting a stranger at home or in a parking lot, and dealers usually have multiple cars to compare in your price range.

Pros of Buying a Car From a Dealer

One-stop shopping: Dealers offer inventory and services in one place. You can browse several cars, test drive, arrange financing, and complete the paperwork in a single visit.

Safer environment: While nothing is risk-free, dealerships reduce many of the safety and payment concerns that come with private sales. The transfer of funds is typically more secure and documented.

Available warranties: Many used-car dealers offer short in-house warranties for early ownership issues. Third-party extended warranties may be available. PRO TIP: Before buying an extended warranty, understand exactly what’s covered, how claims are handled, and whether you must pay upfront and wait for reimbursement. Verify the warranty company’s reputation. Generally, used car extended warranties are not worth buying.

Regulation protection: The federal “Used Car Rule” applies to used-car dealers, limiting deceptive practices and requiring certain disclosures about a vehicle’s condition and warranty.

Reputation: Dealers—especially franchised stores for brands like Chevrolet or Toyota—have more at stake if they misrepresent a car or fail to honor promises. Their business depends on reviews and repeat customers. A private seller who only sells a car every few years has far less incentive to protect their reputation after the sale.

Cons of Buying From a Dealer

Price: Dealers exist to make a profit, so they sell cars for more than they paid—sometimes a lot more. Their markup helps cover overhead (utilities, payroll), paperwork, and sales commissions, none of which apply to private sellers. As a result, buying from a dealer typically costs more than a peer-to-peer sale.

Limited inventory: Dealers offer multiple cars, but you’re still restricted to what’s on their lot. If nothing fits your needs or budget—especially with today’s tight inventory—you’ll have to visit another dealership.

Uneven playing field: At a dealership, you’re on the seller’s turf. They control the process and have far more experience negotiating, which can feel intimidating. PRO TIP: Research the dealer’s inventory online before you go. Pick a few specific cars to see. If those aren’t available or don’t meet your needs, leave and research another dealer rather than settling under pressure.

5 Tips: Getting Your Best Used Car Deal at a Dealership

- Know its value: There’s no excuse to walk in blind. Use Kelley Blue Book’s Car Values tool to see the current market value for the specific year, model, and trim. When you know what the car typically sells for, you’re in a strong position to negotiate.

- Negotiate trade-in value: If you’re trading in a car, look up its value on Kelley Blue Book first. If the dealer’s offer isn’t close to that number, consider selling your car yourself or to another dealer instead of leaving money on the table.

- Shop the interest rate: Interest rates are based largely on your credit. To see where you stand, prequalify with a couple of lenders. Prequalification doesn’t affect your credit score and gives you a ballpark loan amount and rate you can use to compare against the dealer’s offer.

- Buy only what you need: The finance office is full of tempting add-ons—warranties, GAP insurance, service plans, and more. Each one bumps up your monthly payment and the total interest you’ll pay. Many of these products can be bought later, often for less. Stick to what you truly need.

- Question every fee: You should expect legitimate charges like tax, title, license, destination, and a documentation fee. Scrutinize everything else. Fees such as loan protection insurance, dealer market adjustments, and prep fees are often negotiable—and sometimes unnecessary.

What to Consider Before Buying a Used Car?

Buying a used car requires considering several factors, some of which we’ve already mentioned. However, a few of them are worth breaking out and discussing in more detail.

Vehicle History

Always review a vehicle history report before buying. It shows past owners, accident history, mileage issues, and more. Dealers often provide these reports; private sellers usually don’t, so you may need to purchase one yourself from providers like AutoCheck or Carfax.

Look for documented routine maintenance. A solid paper trail suggests a well-cared-for car. A private seller, in particular, should know the car’s service history and be able to show receipts.

Financing

Financing a used car is often tougher than financing new. Rates are higher, and some lenders won’t finance older or high-mileage vehicles.

For a peer-to-peer purchase, if you can’t pay cash, you may need a personal loan, home equity line of credit, or a used-car loan. Lenders will want detailed vehicle info and may require you to finalize the sale at their office to oversee the title transfer. It’s extra time but adds security.

Taxes

Whether you buy from a dealer or a private seller, you’ll likely owe sales tax. At a dealership, tax is folded into the purchase and collected by the dealer. With a private seller, you pay it when you transfer the title and register the car. Check your state’s rules and rates ahead of time to avoid surprises.

Insurance

You’ll need insurance in place before driving away, regardless of where you buy. Contact your insurer in advance to confirm coverage and your new premium. PRO TIP: A new-to-you car is a great time to shop around for better insurance rates.

Purchase Price

In the dealer vs. private seller trade-off, you typically pay less with a private seller but take on more of the post-sale work a dealer normally handles. Either way, your final price depends on how well you negotiate.

Which Is Better: Private Seller or Dealer?

Private sales come with more potential pitfalls, but many risks can be reduced by using Autotrader’s Private Seller Exchange. You get a more secure, streamlined transaction and often still pay less than at a dealership.

In most cases, the decision comes down to finding the right car at the right price. If it’s at a dealer, expect to pay more but save time and hassle. If it’s with a private seller, you’ll likely pay less but handle tasks like visiting the tag office to transfer the title, register the car, and pay taxes.

In short: do you want to spend more time or more money?

Editor’s Note: We have updated this article since its initial publication. Renee Valdes contributed to the report.

Great article. Is it even legal for a car salesman to sell you acar for 3 times the book value? Didn’t think we had to check the value, but did 3 days after, and found out we bought the vehicle for $15,000 and book value was $5,000! After charging 18% interest, how can someone even attempt to justify charging that much extra?

I think private party for used car is better that a dealer.

Does CarCheck really give the previous owners??? as this article says? I know CarFax does NOY.

Hi Bob. Thanks for reading. Vehicle history reports like AutoCheck and Carfax indicate the number of previous owners and the city or county and state where the car was registered, but not the previous owners’ names.

What frustrates me is I’ve sold my used vehicles privately in the past, but people want to low-ball you. For example, in 2018, I had a 2013 Ford Escape Titanium for sale. The dealers were asking $15k for similar vehicles, I was asking $12k and buyers were offering $7-8k. Why so low?!? $12k compared to $15k was a steal, but no, people want to low-ball you. I FINALLY sold that vehicle for $9k. It was double the $4,500 the dealer wanted to give me as a trade-in, but still pretty low in my opinion.

Dealers typically are going to do everything they can to sell you added on stuff to increase their profit margins. I’ve bought two used cars from dealers in the last 7 years and both tried to sell me add ons like theft protection and GAP insurance at ridiculous prices. I’ve also found some dealers just don’t care about their reputation and they will try their best to pull one over on you. I’ve been lied and cheated by dealers.

I was looking on craigslist and dealers for Ford Fusions,same years and options and the prices were like $3000 dollars difference.

I have noticed throughout years that buying a car from major dealer is a better deal than from private.

I think judging with scrutiny who are you buying from. I’d feel most comfortable if I was buying from an old bird or a family of someone who passed away and it was theirs. I’m just guessing, but I feel that more people than not would want to get rid of something because they had a few problems and want to trade the QB while he’s still got a good couple years left.

Pardon my typo. It’s a 3 month warranty.

It seems about 50/50, private vs dealer. So then, is going with a dealer with a 30 day warranty, all other things being equal, a better choice?

Great article, it’s important to know a good deal when you see one as well as buying from a reputable Seller.

Judging the person can be as important as judging the car.