Quick Tips on Exchange Funds in Private Car Sales

- Cash is easy and quick, but exchanging bundles of bills with strangers can be risky.

- Checks aren’t foolproof; even certified and cashier’s checks can be counterfeit.

- A full-service platform like Autotrader’s Private Seller Exchange is a third party providing many benefits, including guaranteeing the integrity of the money transfer.

Privately selling or buying a car (peer-to-peer) can be a stressful experience, especially for first-timers. Even for those more experienced in the private marketplace, though, there is always a degree of uncertainty. Topping the list of worries is exchanging funds in peer-to-peer (P2P) car sales. Without taking certain precautions, it is nothing short of a leap of faith.

According to Autotrader’s parent company, Cox Automotive, nearly 19 million vehicles are sold peer-to-peer annually. Historically, there have been six primary methods for fulfilling a peer-to-peer car transaction. Each has advantages and disadvantages, including speed, security, cost, availability, etc. Although these traditional methods facilitate the transaction, they end there.

If you are the seller, you are on your own, setting the price, marketing your car, verifying the payment, and performing any other tasks involved in moving the iron. It’s the buyer’s responsibility to verify the legitimacy of the title and transfer it, arrange any financing, and so forth.

Suppose you are thinking about selling a car on your own. In that case, you should familiarize yourself with the various payment options, which now include a seventh option: the Autotrader Private Seller Exchange (PSX). It’s a new, safer, full-service platform for peer-to-peer car transactions that’s fully accessible on a smartphone.

Continue reading, and we will detail your transaction options and highlight the main strengths and weaknesses.

- Cash

- Certified Check

- Cashier’s Check

- Bank Transfer

- Escrow Service

- Digital Payment Platforms

- Private Seller Exchange

Cash

There’s no question about it; cash is easy and quick. Not only does it satisfy the instant gratification of profit from selling a vehicle, but it also immediately puts the buyer behind the wheel. It also ensures privacy because no other person or entity is involved. However, exchanging cash between relative strangers poses a degree of risk.

Major Advantage: Speed.

Major Disadvantage: High amount of risk.

Certified Check

To certify a personal check, you simply take it to your bank, which verifies that sufficient funds are in your account. It marks the check as certified and holds those funds exclusively for payment of that check. In other words, it guarantees the account balance will cover the check when presented for payment. Because payment is guaranteed, the seller’s bank usually treats it as cash when deposited, providing immediate access to the funds. Other banks may process the payment as a regular check, delaying the seller’s access to the funds.

Fraud is still possible because the certification can be forged. Therefore, the seller should verify the check with the issuing bank before releasing the title or the car. Your bank may or may not charge a fee for certification. In general, we advise sellers to avoid certified checks because of the possibility of fraud and the potential for delayed payment.

Major Advantage: Physically safer than cash.

Major Disadvantage: Fraud is a possibility.

Cashier’s Check

Where a certified check is drawn on an individual’s account, a cashier’s check is drawn from the bank’s funds. In essence, the car buyer purchases this guaranteed check from the bank by giving the bank the funds to cover the payment and a transaction fee. The bank then issues the cashier’s check from its account. Issued and guaranteed by the bank, a cashier’s check is more secure than a certified check. Moreover, other financial institutions consider a cashier’s check as cleared funds. Most banks charge a nominal fee (often $20 or less) for issuing a cashier’s check.

Sellers should remain aware that unscrupulous “buyers” can create counterfeit checks. It’s likely inconvenient, but meeting the buyer at their bank to see them obtain the cashier’s check will be worth the hassle.

Major Advantage: Other banks treat cashier’s checks as cash.

Major Disadvantage: No check is foolproof.

What’s the Difference Between a Cashier’s Check and a Certified Check?

A certified check is written on an individual’s account, while a cashier’s check is written on a bank’s account. For a personal check to be certified, the bank must verify the funds are in your account, set them aside, and then mark the check as certified. That assures other banks that the check is good. To get a cashier’s check, you must give the bank cash in the amount of the check and any required fees. The bank then issues a check for the agreed amount from its account. Other financial institutions treat a cashier’s check as if it were cash.

Bank Transfer

Using a bank transfer removes fraud concerns and ensures a safe transfer of funds during a car sales transaction. That’s because it becomes an exchange between the buyer’s and the seller’s banks. No cash that can be stolen nor checks that can be forged are involved. The buyer transfers money from an account in their bank to the seller’s account. The downside is that bank transfers might take 24 hours or more and have a fee of up to $50.

Major Advantage: Trustworthy and secure funds transfer.

Major Disadvantage: It can take 24 hours or longer.

Steps to Transferring a Car Title

If you don’t do it with some regularity, transferring a car title can be a bit daunting. In a P2P car transaction that is already a stresser, the title transfer — particularly if the seller still has a loan balance on the car — adds another layer of angst to the procedure. Every transaction is a two-party process in which both the seller and the buyer bear specific responsibilities. This fact is borne out in the title transfer process, too.

Each state has its own regulations for title transfer. It is an exercise in dotting i’s and crossing t’s. In other words, precision is everything. Here, we provide a general overview of title transferring. Some details may differ in your state; however, this is a common-denominator blueprint.

Pro Tip: Always double-check your state’s requirements for transferring a car title before putting pen to paper.

- Verify the title (seller): The seller must produce the original title. A copy won’t do. Issued by the state, the original will be printed on quality stock paper and contain a state seal or stamp. Printing should be crisp, clear, and free of alterations or corrections. The VIN (vehicle identification number) listed on the title must match the car.

- Assignment of Title (seller): This is the section – often on the reverse side of the title document – in which the seller fills in all the appropriate blanks. These include the seller’s name exactly as it appears on the front of the document. When more than one name appears as an owner on the front, there may be joint ownership, which will require signatures from all listed parties. Other information to fill in is the current odometer reading, the exact sale price, and the transaction date. It’s the buyer’s responsibility to ensure all this information is accurate. For example, check the seller’s name against a photo ID and physically check the car’s odometer reading.

- Sign the title (seller): With all the required blanks filled in, the seller – or sellers in the case of multiple owners — must sign for the transfer to be valid. As a seller, do not sign over the title before verifying the funds. Ensure the funds are secure before signing, no matter the payment’s form. Your state may require your signature to be witnessed by a notary.

- Bill of sale (seller and buyer): Some states also require a bill of sale signed by both buyer and seller. It includes all the information on the title, such as the date, transaction price, year/make/model of car, the VIN, odometer reading, and names, addresses, and signatures of the buyer and seller. Check with your state for its exact requirements.

- Sign the title (buyer): The Assignment of Title requires the buyer to complete a section containing the buyer’s full legal name, address, and signature. This information and signature can be completed at any time before visiting the DMV.

- Proof of insurance (buyer): Unless you live in New Hampshire, you will need proof of auto insurance to complete the title transfer. We recommend getting your insurance lined up before purchase to ensure there won’t be any issues.

- DMV (buyer): To complete the title transfer, you must visit your local Department of Motor Vehicles (DMV). You’ll need the completed and signed Assignment of Title, a valid driver’s license, proof of insurance, the bill of sale (if required), and proof of any required state inspections: emission, safety, and so on.

- Fees and taxes (buyer): The payment of any fees (title transfer, registration) and taxes due is also required to complete the title transfer. This action takes place at the motor vehicle agency or the state department of revenue.

What if There Is a Lien on the Title?

Odds are good that if the seller doesn’t have the original title but produces a copy instead, a lender will appear on it as the actual owner of the car. In other words, the seller still owes a balance on a car loan. There are other reasons a title might show a lien, such as an unpaid repair bill, but no matter; a lien means the title isn’t clean.

Any outstanding balance must be satisfied (the lender paid in full) before a title can be transferred to a buyer. In the case of an outstanding loan balance, the simplest and safest way to proceed for buyer and seller alike is to exchange funds at the lender’s offices. It ensures the lender is paid in full, the seller receives the balance of the buyer’s payment, the buyer receives a clean title, and everyone lives happily ever after.

Yes, there are other solutions, but they involve some extra risk for either the buyer or the seller. Of course, you can use our Private Seller Exchange. Read on.

RELATED: How to Transfer a Car Title

Escrow Service

If you’ve ever purchased a home, you probably have encountered the term escrow or escrow account. Regarding a car transaction, an escrow service is a third-party repository for holding the funds the buyer pays until the vehicle exchange is complete. At that point, it releases the funds to the seller. If the sale somehow goes wrong, both parties are protected. The escrow service returns the funds to the buyer.

With the introduction of a neutral third party, both buyer and seller enjoy added security and a paper trail. On the downside, escrow services tend to slow down the process because the payment takes time to verify and process. Moreover, the escrow fee can be as much as 2% of the sale price. In other words, the higher the transaction price, the larger the fee. For example, using an escrow service to exchange funds for a $12,000 transaction could run as high as $240.

Major Advantage: High degree of security.

Major Disadvantage: Potentially costly fee.

Digital Payment Platforms

Growing in popularity, digital payment platforms like Venmo, PayPal, and Zelle provide a degree of convenience that some other forms of payment lack. Furthermore, they are quick and secure. However, they can have transfer limits. Moreover, each platform requires the buyer and seller to verify accounts. Also, the fees can be steep for purchase transactions. For example, Venmo charges sellers 1.9% of the transaction. Using our hypothetical $12,000 scenario, Venmo would charge the seller $228. Furthermore, if the seller then wanted to transfer the balance to a personal banking account, Venmo charges another 1.75% ($210) for that service.

Major Advantage: Convenience.

Major Disadvantage: Both parties must have verified accounts.

RELATED: Can You Buy a Car With a Credit Card?

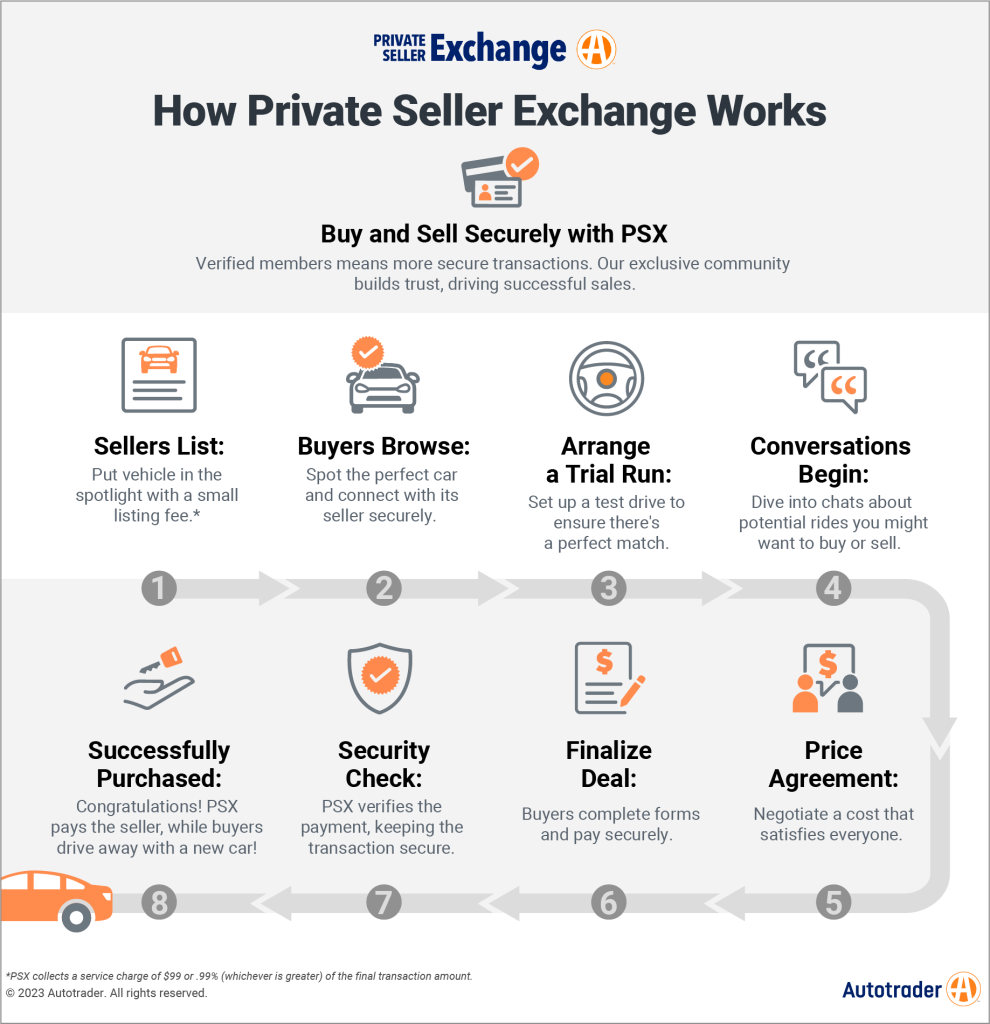

What is Private Seller Exchange?

Autotrader’s Private Seller Exchange is an industry-first peer-to-peer vehicle-buying marketplace where consumers can buy and sell cars with safe, secure transactions while taking advantage of a wide range of popular services. Peer-to-peer refers to buyers and sellers who are private individuals rather than one or both being a car dealer.

If you rolled all the major advantages listed above into a single peer-to-peer transaction model, you might arrive at something similar to the Private Seller Exchange. It lets you buy directly from a private seller without sacrificing security, convenience, or quickness. PSX is a secure marketplace where both seller and buyer build a bridge of trust through investigation, verification, communication, and transaction, expedited and validated by PSX.

Unlike other peer-to-peer transaction options, PSX acts as a third party and guarantees the integrity of the money transfer. It also provides various other vital services benefiting buyers and sellers from the beginning to the end of the process. Think of PSX as a full-service facilitator offering solutions to the issues that buyers and sellers face in peer-to-peer car transactions. It’s a cafeteria platform; buyers and sellers can choose from the available services from the comfort of their homes through a smartphone.

Sellers must register and provide information about the vehicle they want to sell. The fee will be no more than $99 or 0.99% of the final transaction price, whichever is greater. Buyers merely need to pick a car from the inventory at the Private Seller Exchange Used Cars for Sale by Owner.

Seller Services Include:

- Exposure to thousands of car shoppers.

- Pricing guidance.

- Easy scheduling of test drives.

- Top dollar for the vehicle.

- Secure, fraud-free payment.

- No-hassle title transfer.

Buyer Services Include:

- A vast inventory of available vehicles.

- One-on-one access to the seller.

- Private-party pricing.

- Help with arranging test drives.

- Access to inspection services.

- Payment facilitation.

- Seamless and secure title transfer.

- Lien-free title.

- Available gap insurance.

- Warranty marketplace.

Peer-to-peer car transactions have never been easier or more secure. There are no trips to the bank or the DMV; everything except a test drive can be accomplished on your personal device.

Editor’s Note: This article has been updated since its initial publication.

What happens to the buyers and sellers information after the sale? Are Driver Licenses, addresses, phone numbers and bank information deleted? Also, is any information shared with any marketing agencies?

How does the title process work in this type of transaction? How can I ensure, as a buyer, that the title will be transferred to my name?

Hi Tammy. Thanks for reading. It’s the seller’s responsibility to transfer ownership and cancel the vehicle’s registration. The buyer should ensure that the seller completes all of the required sections. This is typical done when the money changes hands. You’re also responsible for registering the car in your name within a week (or similar timeframe, depending on where you live), and for that, you’ll need that title and a bill of sale from the seller.

Am I able to give the seller part cash and use PSX for the other part?

What if a buyer is going to buy the car with a loan from their bank, how do they send the payment to auto trader. Do they give the bank auto traders info or is their a way for a buyer to get financing through help from auto trader?

Thanks for reading, Daniel. When an individual using PSX gets financing through their bank, Autotrader emails the buyer a purchase order they can take to their lender.

The says things like “guarantees the integrity of the money transfer” and “Payment facilitation”, but doesn’t explain how that is done. I can’t find details anywhere about this.

Hi Phillip, thanks for reading. PSX acts as escrow, extending buyers multiple forms of payment, including wire, ACH, credit card, and finance options in select states. PSX verifies the funds from buyers and retains those funds in our account until the buyer has possession of the vehicle. At that time, we pay the seller, who can be confident that the payment is legit without worrying about fraudulent payments, counterfeit bills, fake checks and so forth.

Can I sell relatives car ( title in their name) work out of town so makes it difficult for them to show vehicle. What is total cost to list and sell vehicle?

Thanks for reading, Dave. You or someone else can show your relative’s car to potential buyers. Your relative must possess the title and be available to sign it over to the buyer. Selling the car through Autotrader’s Private Seller Exchange provides secure transactions for just 1% of the final sale price, or $49 (the cost of the listing ad) if the car is sold for $10,000 or less.

Is there a limit to how long the funds can be with PSX before the car is transferred? I can’t part with my car immediately but I’d like to get the commitment from the buyer. It would be about a week from the time the buyer pays PSX until I can turn over the keys. (I’m visiting from out of state, selling my mom’s car for her but I need the car to get around in until I depart for home.)

Hi Chris. When using Private Seller Exchange, the time it takes to transact is completely up to the seller and buyer. If the seller is willing to, or needs to, wait, they’re more than welcome to. We look at it like it’s their car and have no obligation to sell their vehicle to anyone that doesn’t meet their needs for timing or agreed price. It’s up to the seller and buyer to determine the timing in both purchase and pick-up time or transit time if the buyer uses a preferred carrier/shipper.

How long does it take from buyer initiating payment until verification of funds? For example: if we meet Monday at 4 and he “pays” through autotrader, autotrader then verifies funds… when should we expect to hand over the vehicle?

Hi @AM. In general, purchases through PSX are usually completed the same day. The purchase process is relatively fast. Simply click ‘Buy Now’ on the vehicle detail page or your dashboard, and confirm online how you want to pay for it (e.g. with PSX financing, with cash, or with your bank).

How do I complete a sale when there is a loan payoff amount? Does the buyer need to make two payments, or can I have them make a single payment to my bank with the bank transferring the overpayment to my checking account? How does the title transfer work?

Hi Zafra. Thanks for reading. Our customer care folks might have info specific to your situation, but I can pass along this from a Private Seller Exchange FAQ:

When you sell a car through PSX, we handle your loan payoff at the point of sale.

What do you need to do? It’s simple:

If you have a loan: at the time of listing, simply provide us with your estimated loan payoff amount and loan account number, and let us know who your lender is. Make a quick call to your lender and ask them for your payoff amount. Typically, your lender will call this a “10-day payoff amount”.

If you have a lease: PSX is not currently constructed to finance or transact vehicles under a lease. You may list your vehicle on Autotrader or sell it quickly using Kelley Blue Book® Instant Cash Offer. If you still want to sell your vehicle through PSX, you must first exercise your right to buy the vehicle outright from your lessor.

What’s next? When you have a buyer, we’ll confirm your exact payoff or buyout amount with your lender. Once your buyer has made payment in full and the sale is final, we issue that payment to your loan company directly.

If your buyout or payoff amount is more than what your vehicle sells for (factoring in our sale fee), PSX will let you know what you owe to cover the remaining amount due. So, if your vehicle sells for less than what you currently owe on it, you’ll need to pay that difference in full at the point of sale. This is sometime called being ‘underwater’ on your loan. If you sell your car for more than you owe, then you’ll of course get to keep any amount in excess of what you owe.

PSX is not able to offer financing or payment plans on underwater payments, but we’re happy to advise you on what your options are and help to determine if you’re ready to sell. Get in touch with our team any day of the week via phone, or email.

How much is the buyer required to pay in escrow fees with the private seller exchange when paying in full?

Hi Dave. I hope I can clarify escrow fees in Autotrader’s Private Seller Exchange. The escrow fee helps cover costs for shipping and other fees in securing your clean title so that you can remit tax and registration at your local DMV to receive your new perfected title and registration. Other state requirements may apply. Escrow buyers will pay tax and registration costs to their local DMV directly.

So escrow buyers all pay a flat $199 but will not remit tax or registration to psx in select states. Other buyers may be subject to a documentation fee (similar) ranging from $85-$199.

— Buyers who are remitting tax and registration to PSX are paying a doc fee ($85-$199).

— Buyers who are not being asked to pay tax and registration costs to PSX are paying the Escrow Fee (Flat $199).

Can I transfer a car on a Sunday? Customer service is not even open today. I do not want to release my car until I know the funds have been released first.

Hi Tom. A buyer and seller can transfer a vehicle on Sunday, provided each has received a confirmation email that the car is OK to exchange. For example:

The buyer pays on Thursday. Autotrader reviews the deal and releases it on Saturday. The parties can arrange for the buyer to pick up the car on Sunday.

However, same-day purchase and pickup is not possible on Sundays because Autotrader staff is not available to review payment and release the car. A buyer may pay for a vehicle on Sunday, but transferring the vehicle will need to wait until the following business day after Autotrader reviews the transaction in full.

Our customer service team is available Monday-Friday from 8 a.m.-6 p.m. Eastern time and Saturday from 9 a.m.-6 a.m.

Is this another service owned by the likes of PayPal that always sides with the buyer?

Private Seller Exchange isn’t in the business of taking sides, Don. PSX is a service from Autotrader that simply bridges the gap between sellers and buyers. It’s a marketplace where verified consumers can buy and sell cars with safe and secure transactions, while taking advantage of a wide range of services.

Private Seller Exchange isn’t in the business of taking sides, Don. PSX is an Autotrader service that bridges the gap between sellers and buyers. It’s a marketplace where verified consumers can buy and sell cars with safe, secure transactions, while taking advantage of a wide range of popular services, including transferring the title.

It is 1% not 10%

Looks like PSX charges 0.99%, just less than 1 percent. That would make the fee $200 on $20k car.

I was thinking the same thing Alan. If I’m buying a car for $20k, then they are going to charge me $2k as an escrow fee for what? The only thing that seems to have any value for a buyer is that the title is guarantied lien free. Even then it’s not worth 10% of the price. It doesn’t take much knowledge to ask for a lien release and title from the seller. I’m not going to pay $2k for something I can do for free AND mitigate the risk with my brain. Nah, I’ll pass.

Using the PSX service to buy a car adds about 10% as an “escrow fee”, making the original asking price unattractive. Why would any buyer pay an additional 10% markup to go through PSX? Just buy from a dealer, the markup is lower.