Monthly Car Payment Quick Facts

- Spreading the car’s cost over more months lowers the monthly payment but will cost more in the end because of additional interest charges.

- Know how much you can afford to pay each month. Then use our calculators to determine the car price that fits your budget.

- Focusing on the total price can help you stay in control, not the dealer, and pay what you want to spend.

If you’re interested in buying a car, you’ve probably heard that it’s best to focus on the total price of a car first and then worry about the payment.

But why is this? Why not focus on the amount you’re going to pay every month? It’s a good question, and we have the answer.

Use Monthly Payments to Your Advantage

Traditional auto-buying wisdom says to focus on a total price first rather than a monthly payment because a monthly payment can become problematic if the dealer learns your budget.

For example, if you want to keep your new car payment to $400 per month, the dealer might easily get your payments within your budget. But to do so, they may have to spread out the payments over a long term, such as 72 or 84 months. The result is that the car will be a lot more expensive by the end.

In our example, a car payment of $400 per month for five years (60 months) equates to $24,000. But the same $400 per month spread out over six years (72 months) is $28,800, while it’s $33,600 over seven years (84 months). If you solely focus on payment, these might all seem like the same $400 per month, but if you focus on the sum of all those payments, you’ll see significant differences between these figures.

RELATED: What Term Should Your Car Loan Be When Buying?

Average Monthly Car Price

As the cost of vehicles increases, so do monthly payments. Data from Cox Automotive, Autotrader’s parent company, indicates the estimated typical new car monthly payment in the first quarter of 2023 was $766. Used car buyers paid about $250 per month less. According to a report from the credit monitoring company Experian, the average monthly payment for a used car in the same period was $516.

The amount financed with an auto loan is the biggest part of a monthly car payment, and interest paid to the lender makes up the rest. In general, borrowers with lower credit scores have higher interest rates on loans, resulting in higher monthly car payments.

Finding Price Range for Your Monthly Budget

A car payment is a critical consideration for most shoppers interested in buying a vehicle due to budget needs or constraints. Never overextend your budget for a car.

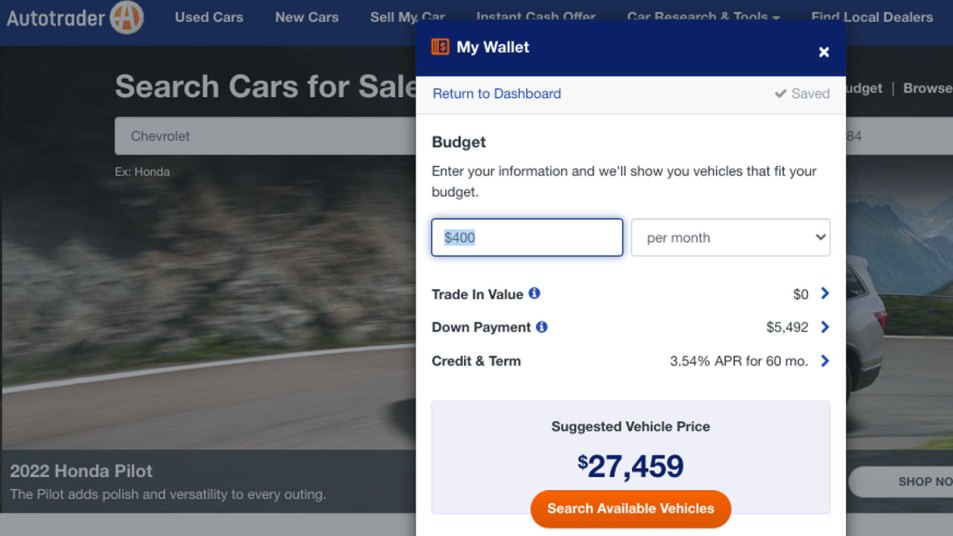

You can find out your budget by using our My Wallet tool, found on the dollar sign icon in the upper right-hand corner of the Autotrader website.

Using the tool, you can plug in your monthly budget for a car and add your car trade-in value, if applicable. Then, add your down payment amount and credit terms, or let the tool find loans for you based on your credit score range.

The My Wallet tool provides a suggested vehicle price to you, and then you can search and shop available vehicles in your price range.

Focus on the Total Price, Too

At the dealership, just remember that the dealer can increase the loan term to make a car’s monthly payment fit into your budget. But there’s no way to do that with the total price. Since the total price is final, there aren’t any tricks to make it seem lower than its actual cost.

So remember, do your homework first. Determine the total price you can afford by plugging in your parameters to determine a monthly payment that you can afford using the payment terms you want at a predetermined interest rate you want to shop for at the dealership.

That way, you’ll pay exactly what you want to spend — or less. And you’ll be in charge, not the dealer.

How Big Should the Down Payment Be?

The more you put down a car, the less money you must finance with a loan. The less you finance, the lower the monthly payment. Some lenders may require you to pay 20% of the purchase price with cash as a down payment. Even if that percentage isn’t mandatory, it’s a good rule of thumb to follow.

How to Calculate Monthly Car Price

Use our Auto Loan Calculator to learn the monthly car payments for your next vehicle. It starts with the vehicle price (including taxes and fees) and subtracts the down payment amount and trade-in credit. The interest rate is applied to that figure, and the total is divided by the number of months in the loan term. The result is the estimated monthly payment for the vehicle that interests you.

Editor’s Note: This article has been updated for accuracy since it was originally published.

Way to go Autotrader. Drive that wedge deeper and deeper between you and the dealership.