New car prices are on a steady uptick. Kelley Blue Book estimated in December 2025 that the average transaction price for a new vehicle was $50,326 — an all-time high. That’s an eye-popping number for the average car buyer who’s on a leaner budget, but it shouldn’t mean sacrificing a decent ride. Many buyers are instead turning their sights toward older used cars that still offer a blend of affordability and reliability.

Unfortunately, older cars can introduce unique challenges when it comes to financing. Risk perception with older or higher-mileage vehicles can play a bigger role with lenders, as can certain lender restrictions like mileage caps or minimum loan amounts. Vehicle age can also influence interest rates and loan terms.

The good news is that many lenders are recognizing these market changes and the need to expand financing options for older cars. So, if you’re considering financing an older car, here’s your action plan.

Know Your Budget

Before you do anything else, you need to know what you can reasonably afford. “Buyers can get caught in a trap where they have a strict budget but allow it to sneak up as they get tempted by more desirable features or newer vehicles,” said Autotrader Senior Advice Editor Chris Hardesty. “It’s imperative that once you determine your budget, you stick to it.”

Before you even begin your car search, you need to assess:

- Down payment: If you have cash available, even a small down payment can make a difference in reducing the interest you’ll pay down the line.

- Credit score: This number will impact your loan terms. You need to know where you’re at, and if your score is not where you want it to be, strategize to improve it before you buy your next vehicle.

- Overall budget: It’s imperative to think about how much you can actually afford each month for a car payment. Consider your housing, regular bills, savings plans, and other expenses to get a big picture of what you can reasonably spend monthly on your car. When you meet with your lender, have this number in mind and stick to it.

You can use our calculator to help you figure out a number that works for your life and what’s going on within it.

When you’re looking at your budget and taking stock of what you can afford for a vehicle, don’t forget to factor in the hidden costs of car ownership. Gas, insurance, annual registration, and regular maintenance all need to be addressed in your financial planning.

AUTOTRADER PRO TIP: Start regularly setting aside money in a repair fund now, especially if you’re looking at buying a higher-mileage vehicle. Larger repairs are costly and can’t always be predicted or planned for, so having a cushion can go a long way to keeping your finances on track.

Do Your Research

Once you know exactly what you can afford and what you’re willing to pay each month, you can look for cars that fit the bill. Start by evaluating the reliability of the brand, make, and model year you are considering. Use trusted comparison and valuation tools to do this.

Once you’ve located a few options you’re interested in, do some digging on the vehicle’s history. Make sure it has a clean title. Salvaged vehicles and those with branded titles will face an uphill battle to secure financing. Verify the maintenance history to make sure that the car has been well cared for. Generally, the fewer previous owners, the better.

“Lenders are a bit like insurance companies in wanting to assess risk levels,” explained Hardesty. “A clean bill of health on the car up front will make it much more appealing to fund as it means a lower probability of big, expensive problems down the line.”

MORE: 5 Tips for Financing a Car With Bad Credit

Explore Your Financing Options

Once you know your budget and have researched and identified a vehicle with a clean history that fits in it, you can explore your lending options.

Experian data from Q3 2025 showed the average interest rate on a used-car loan ranged from 7.43% to 21.60% depending on loan length and credit score, with the average interest rate landing at 11.40%. This is a big range, so shopping around for the best rate and exploring your options will be crucial.

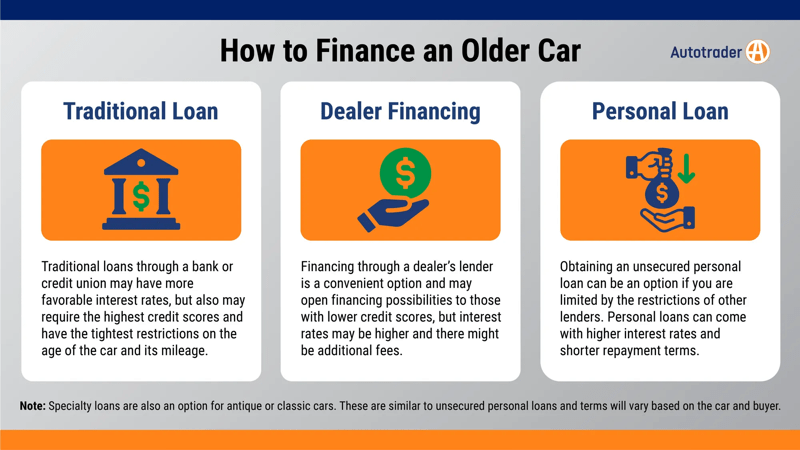

Traditional Loan

Most major banks will finance an older or high-mileage vehicle, but they tend to have the tightest restrictions. These will vary from bank to bank, but generally, loans will be available for cars that are not older than 10 years old or have fewer than 125,000 miles. Banks will also be hesitant to finance salvaged, branded-title, or lemon law vehicles.

To obtain a traditional bank loan, you’ll need a strong credit history and stable income, and the vehicle must be in good condition with a clean title. If you fall into these categories, a traditional loan might be a good option. However, if your credit isn’t great or the car you’re considering is older than 10 years, you might need to look elsewhere.

Credit Union

Because credit unions are owned by their members rather than shareholders, they’re often able to offer lower interest rates than large banks, and they can set their own restrictions on a case-by-case basis. For example, where a traditional lender might not be willing to issue a loan for a 15-year-old vehicle, a credit union may still consider the loan based on the vehicle’s history and condition.

You will need to be a credit union member and have an account, but this will also give you access to the credit union’s services beyond auto loans.

Dealer Financing

Of course, you can always finance your purchase at the dealership through its preferred lender. It’s often very convenient to do so, and there may be some incentives offered. If you have poor credit and need specialized options, dealer financing may be able to help you out, but we urge caution when going this route.

Dealer financing often has a high APR. Read the fine print in full to understand exactly what any “special offers” or “introductory rates” truly entail. A reputable dealer should be able to explain every aspect of the loan and give you an honest breakdown of your payments.

Personal Loan

There are some cases when you may just not be able to obtain financing through any traditional means. These reasons can include:

- The car may simply be too old or have too many risk factors, like a salvaged title.

- You have no credit history or a very low credit score.

- If you don’t have regular, verifiable income.

- You have a recent repossession or bankruptcy.

In any of these cases, an unsecured personal loan may be your only or best option. You won’t be subject to the same restrictions, and you can often get quick approval. If you’re purchasing from a private seller, this may be an option to consider, or if you don’t want to use your car as collateral on the loan.

Think carefully about this option, as personal loans often have much higher interest rates and shorter repayment terms. Some will require a high credit score, and some personal loans can come with high upfront origination fees that will increase your total cost.

| Note on specialty loans for classic cars: If you are looking to purchase an antique, classic, or “collector” vehicle, you can consider financing it with a specialty loan. Specialty lenders evaluate the value of the car based on factors like rarity, condition, and your credit score. These loans are similar to unsecured personal loans, but may offer more favorable terms based on the car and your individual financial situation. |

| Note on loans between family and friends: There are also truly personal loans between individuals. A family member or friend may be willing to loan you the money, but beware the pitfalls. This type of exchange can negatively affect personal relationships if anything goes awry. If it’s not a relationship that you’re willing to see impacted by any potential financial snafus, it’s wise to avoid these types of transactions altogether. |

Part Cash, Part Financing

As we mentioned above, a down payment can make a big difference in your bottom line when it comes to a loan. Any amount that you are able to put down in cash will reduce the principal that you will ultimately have to pay interest on.

If you are able to wait a little while in order to save a larger down payment, that’s definitely a good option and may also give you a little more leverage in your negotiations with a dealer or seller.

Get Your Paperwork in Order

When you’ve decided on a car and a financing method, it’s time to gather your documents. Make sure you have:

With all these ducks in a row, you can confidently sign on the dotted line and hit the road with your new (old) car that will keep you cruising for many years to come. And you can feel proud that you were financially savvy in handling the deal from start to finish.

Editor’s Note: We have updated this article since its initial publication.

I know this old but USAA will

I joined Pentagon Credit Union based on your suggestion, only to find out that they would NOT finance my 2005 Carrera. Maybe the “used to” do this?

Just came across this the other day when looking for a way to finance a 1995 H1 (coincidence). It’s been converted to the 6.6 Duramax and had many many other upgrades. Needless to say, I’m paying a lot over book value, it’s significantly older than 10 years, and I’m self employed (always a challenge). I have an excellent credit score (about 840), good assets, good income, and little debt. I tried my bank, Wells Fargo (lol), State Farm Bank which I’ve used in the past, and looked at others. No dice. I went ahead and tried out PenFed after finding this article. Process wasn’t bad at all, but the requirements involved income verification through tax returns for the past 2 years, which is tough for anyone who’s self employed and putting a lot of income back into their business and always trying to reduce their tax liability, a vehicle appraisal being as it was higher than book value (which I felt they also put pretty low), and obviously a credit check (which I always love). While lining up those hoops, I read through the comments below and decided to try out Lightstream as well (what could it hurt). That’s where it is!! Lightstream is how it should be done if you’re self employed. The process is simple. They just look at what you’ve accomplished and make a determination off what they see. They’re requirements looked at the credit score (good for me), assets (house equity, cash in bank accounts, retirement funds, lack of credit card debt, etc), and simply only asked for a general income amount but seemed to understand that business owners may purchase a warehouse and new company vehicles in a year that they don’t need the cash income and not have a large tax return. They didn’t seem to care at all what kind of vehicle I was buying. I guess they figured that not only was I smart and trustworthy enough to pay back the loan, they also figured that a person who seems to have it together would also be smart about their purchase. That all being said, had I completed the process with PenFed and been approved, my interest rate would have been 0.59% lower. So, in conclusion, to hell with big banks when it comes to vehicle loans, PenFed is a winner if your paper income is good for the past couple years and the vehicle you’re getting isn’t too crazy, and LightStream is great if you’re in the boat (pun on the H1) I’m in.

Thanks for your comment Matthew! Like you, I’m self-employed with a pretty good credit score (798 currently), good assets, good income, and very little debt. I’ve put a $1,500 down payment on a 2013 Porsche Boxster S with 14,478 miles on it that comes with a 2-year/unlimited miles, bumper-to-bumper Porsche Approved Certified Pre-Owned warranty, which can be extended for another year for $2,100. It’s one of the most sought after Porsche Boxster models and like everyone else I love the car! It will only APPRECIATE in value over time if I don’t put crazy miles on it! But getting reasonable financing so far has been an exercise in futility! 😡😤 I am definitely going to try Lightstream! Thanks! 🙏😃

I used Lightstream to finance my Humvee. It’s a secured loan, but they didn’t even care what kind of vehicle I was buying. 4% interest with a credit score of 730.

how about a 1 owner 2005 scion xb with 89k miles?

I have to share that Navy Federal is a dream as well. They will go back 20 years on vehicle loans and they finance up to 125% of the full NADA retail value on the car.

I am looking to Re-finance my 2006 Chrysler 300 Touring Edition because I am not happy with the finance company that has it now. Would PenFed refinance my vehicle? I live in Ohio and didn’t know if they handle out of state customers.

You have to have a credit score of 680 or higher. That is there standard for anything older than a 2009. I wish someone would have told me before I had another hard hit on my credit score. They also use your Experian score which is your very lowest score. I was 6 points off with my highest score, but that doesn’t matter. The vehicle I want is a 2006 but has 20k miles on it. Every bank I’ve tried would rather have a 2009 with 150,000+ miles on it as long as the year is 09 or newer. Just plain stupid banks, just plain stupid.

Would a credit Union finance first of all a bad credit loanand if so do you think they would finance a 1986 Monte Carlo SS with newly rebuilt engine, transmission new exhaust body is in mint condition but needs a little work inside but it also isn’t bad my credit score is 518

He wants 10,500 that’s the lowest he will go.

Probably not with that credit score, no.

In 2000 I financed a 1990 Miata through my local credit union. Due to the age (10 years) and mileage (90k miles) they made me do it through a personal loan rather than a secured auto loan, so my interest rate was higher. But although the personal loan was approved for 3 years, I paid it off in 4 months. I just needed a quick float until I got a bonus from work that I knew was coming.

I applied on Pen Fed and was told that they didn’t take any cars over 9 years old for “initial approval”. Anyone else have a similar experience?

Around 2000, I financed a 1979 Mercedes 6.9 through my credit union. They had me bring the car to the local branch, they inspected it and deemed it worth at least the value of the loan and wrote a check to the seller. I was in and out in about an hour.

I was able to use Nationwide for an auto loan for a portion of the cost of an ’86 Porsche 911. It was the only company I could find (without going to a credit union) that would loan at the term I wanted for an ’86 non-conventional vehicle. The interest rate was less than 3 percent, and the process was fairly smooth.

Why would you not want to go to a Credit Union? Unless your debt to income ratio is too high, anyone who uses a Wall Street bank in 2016 is a sucker. Nationwide isn’t bad I guess, dedicated financing houses tend to be better than the legally untouchable scammers we call big banks, but you won’t find better rates, a wider range of cars they’re willing to finance, more caring employees, or more flexible terms than you will at a decent Credit Union. Or even a not very decent one.

ha! i stumbled across this article while thinking about getting a 911 SC i shouldn’t actual buy 🙂

PenFed is awesome, and all it takes is a $10 or greater donation to a military charity to be eligible. Alliant is good too, but I can’t comment on used vehicles financed by them.

After financing my ’01 M5 in 2009 with PenFed, I turned to them to finance the ’02 S2000 I bought in 2013. They gave me 1.74%, which is fairly ridiculous.

How about financing an Ariel Atom?

LightStream, they just financed a 2004 GX470 with 180,000 miles for me.

But why

Yes Credit Unions are the best. I financed a ’99 E320 a few years ago through USAA even though they don’t tend to have the best interest rates. I also just financed a truck through Schools Fed Credit Union here in California and they have put me under 3% both times I’ve used them.

I have de-gunked clogged oil passages on a v70 t5, and replaced vanos and timing guides on a 540it. I still have the 540it and love it, but i probably wouldn’t buy another one unless the guides had already been replaced and there was proof. Performance wise it is much more exciting than the volvo.

Would PenFed finance the S-Cargo?

Good Question…Doug?

“Here’s Why The V8 Audi S4 Is An Awful Used Car”

I discovered Lightstream.com a couple of years back when I was looking for financing for my Honda S2000. The process was pretty simple (all online) and they wired money straight to your bank account upon approval. They finance both private party and dealer sales. I’ve since financed 2 other cars through Lightstream and am pretty happy with them. All 3 of my loans have rates under 3%, so it’s pretty fair.

Nice!

I worked at a Credit Union for 7 years, and can tell you we really mostly concerned ourselves with the current book value of the security and the individuals credit/ability to repay on most auto loans. Which works in some cases like a 360 or Viper that had good book values but if someone wanted to say get a loan on something strange like an E30 M3, which would either be impossible to book value or be hilariously low vs. actual market pricing I’d have to justify the purchase price to my approval officer (getting paid to search autotrader ads for this is the closest I’ll ever come to being Doug) through comparable’s or an appraisal. Got many approved this way that banks wouldn’t touch. Hardest part was when a car did have a book value but was really low (we were only allowed to use the lowest trim spec as our value generally) trying to justify the difference. Had to song and dance this for an 04 Cobra loan I can remember.

The option I think most people know of would be using another form of security on the loan or borrowing. Meaning if you wanted to buy a car that maybe didn’t have great security value but had another vehicle (car, boat, RV) that was free and clear and worth the value of the loan, the bank could use that as security on the loan. Or if someone close to them had investments in that bank they were willing to pledge as a security as well, we did that too.

Interesting!!! I do think PenFed looks closely at the book value. When I was buying my Viper, the guy was asking $38,500 for it. PenFed said — I swear this is true — they would go “up to $38,400.” Uh.

Everyone should be a member of a credit union to begin with…

Agreed. I got into my credit union because of my parents. They have always been great for general banking. They wouldn’t approve me for a car loan at first because I had no credit history really, but as soon as I made my first payment for Ford Credit (who gave me 3.6% apr which isn’t bad) I was offered 1.8% apr through my credit union. I happily refinanced.